NEW YORK (CNNMoney) It's been quite the climb for the stock market in recent days, but investors stopped to take breath Wednesday.

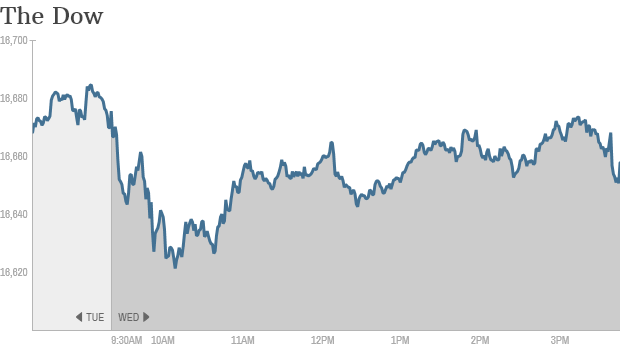

NEW YORK (CNNMoney) It's been quite the climb for the stock market in recent days, but investors stopped to take breath Wednesday. The S&P 500, Dow Jones Industrial average and Nasdaq all ended the day a shade under yesterday's closes.

Here are some highlights from the day's trading:

New record -- barely: The S&P 500 hit a record high on Tuesday of 1,911.9. There was no record close today, although the S&P 500 did tough a new intraday trading record of 1,914 in the afternoon before closing just shy of 1,910.

The Dow fell 42 points, and Nasdaq dropped just under 0.3%.

Although headlines have touted the record highs notched by the S&P 500 and other indexes, it's important to recall that the S&P 500 is about 10% off the frothy peaks of the dot-com era when adjusted for inflation.

Sunken Treasuries: Yield on the 10-year US Treasury note, a global benchmark from sovereign debt, hit 2.44%, the lowest yield in nearly a year. It could be a sign of investor trepidation or the expectation that the European Central Bank will soon take stimulus measures.

Tesla downgraded, Twitter upgraded: Tesla Motors (TSLA) got zapped with junk bond status by ratings agency Standard & Poor's, which pegged the electric carmaker's $3 billion in debt a few notches below investment grade. The ratings firm said Tesla's narrow focus and lack of track record were behind the ratings. Shares a flat in afternoon trading.

Tesla debt: An electric lemon?

Tesla debt: An electric lemon? Twitter (TWTR) shares, on the other hand, jumped over 10% following an upgrade from Nomura bank. The stock is still down nearly 50% for the year.

Retail stocks on the move: Sometimes the shoe really doesn't fit. DSW (DSW), a discount shoe outlet, lost more than a quarter of its market cap in early trading, as earnings came in at the lower end of expectations and same-store sales growth fell 3.7% from the year before.

"I've bought every pair of shoes/sneakers I own for the past 10 years at $DSW. ! Apparently, it hasn't been enough," wrote StockTwits user chicagosean.

Michael Kors (KORS) reported results before the opening bell. Profits were a bit better than expected and sales are up by more than half. Kors shares are up more than 17% since the start of the year as the brand seems to be winning the battle for upper middle class purse consumers. The stock jumped 1.3% today.

Revenue abroad is growing quickly as well. Sales in Europe were double the same time last year.

Homebuilder stocks picking up: Toll Brothers (TOL) reported surprisingly strong earnings before the open, bouncing back from a disappointing start to the year because of the winter weather. Revenue was closer in line with expectations. It was one of the few stocks enjoying a bounce with shares up over 2%.

A handful of other homebuilder stocks are also seeing some small gains as well, including D.R. Horton (DHI), Lennar (LEN) and PulteGroup (PHM).

Airline companies continue to soar: Delta Airlines (DAL, Fortune 500)ended the day 2% higher. It continues to be one of the top performers in the S&P 500 this year. Delta recently announced more routes in and out of Seattle as it grows it presence there, going head-to-head in the "Battle for Seattle" with Alaska Air. Southwest Airlines (LUV, Fortune 500) is also up more than 2% today.

![]()

No comments:

Post a Comment