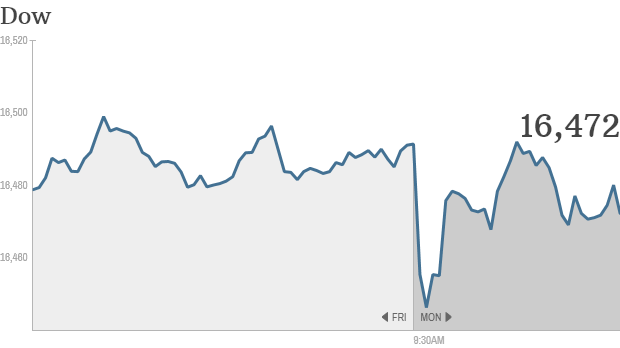

Click the chart for more markets data.

NEW YORK (CNNMoney) Wall Street had mergers on its mind Monday, but so far, these big deals haven't translated into much enthusiasm in the broader market. Stocks are off to a sluggish start.Here are the five things to watch today:

1. Investors are still timid

The Dow was flat and the S&P 500 was up modestly in early trading. The tech-heavy Nasdaq was picking up a bit of steam -- up about half a percent by mid-morning.

The latest reading from the CNNMoney Fear & Greed index indicates investors are feeling fearful after stock markets hit fresh all-time highs last week but then slumped by the end of the week.

2. Big Merger # 1- AT&T and DirecTV

Shares of DirecTV (DTV, Fortune 500) fell after AT&T (T, Fortune 500) said Sunday that it had agreed to pay nearly $50 billion to acquire America's biggest satellite television provider. Shares of AT&T also dipped. If approved by regulators, the deal will continue a wave of consolidation in the television and telecommunications industries. Comcast, (CMCSA, Fortune 500) the nation's biggest cable provider, is currently awaiting regulatory approval for its plan to merge with Time Warner Cable. (TWC, Fortune 500)

3. Merger # 2 - No love from the Brits on pharma deal

AstraZeneca's (AZN) shares plunged 11% in London after the board rejected yet another takeover bid from U.S. pharmaceutical giant Pfizer (PFE, Fortune 500). Investors had pushed AstraZeneca stock higher as they hoped Pfizer would be able to woo the British firm, but the rejection of a fourth and "final" offer from Pfizer suggests the deal is dead in the water.

Pfizer shares were up more than 1% in early trading Monday.

4. Monday's major stock movers

There's not much in terms of economic and earnings announcements on the docket Monday, but a few stocks are on the go.

Campbell Soup (CPB, Fortune 500) reported slightly better than forecast earnings early Monday but lowered its 2014 sale outlook, sending shares lower. It's one of the worst performers in the S&P 500 today. The company said it was unable to heat up its soup sales in the United States despite an increase in promotional activity.

Shares o! f Intermune (ITMN) spiked after the biotechnology firm released positive results over the weekend for a drug that treats pulmonary fibrosis, a terminal illness characterized by scarring of the lungs.

5. World Markets mixed

European markets were mixed in afternoon trading.

Banking stocks, including Deutsche Bank (DB) and Barclays (BCS), were down in Europe after Deutsche Bank announced it was raising roughly €8 billion ($11 billion) from investors to meet regulatory requirements.

Asian markets mostly ended with losses. However, the Mumbai Sensex index continued to rise as investors cheered the election of a new leader, Narendra Modi. ![]()

No comments:

Post a Comment