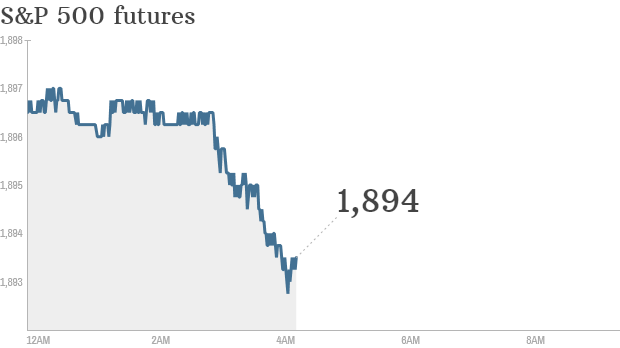

Click chart for in-depth premarket.

NEW YORK (CNNMoney) Wall Street might need a break.The past few days have seen investors push stock markets to all-time highs, but it looks like the pace could slow Wednesday.

U.S. stock futures were barely moving ahead of the opening bell, and there was a negative slant in the numbers. European markets were generally weaker, while Asian markets were mixed.

There are a number of quarterly results set for release that could sway investor sentiment. Macy's (M, Fortune 500), Deere (DE, Fortune 500) and SodaStream (SODA) will report before the opening bell, while Cisco Systems (CSCO, Fortune 500) and SeaWorld (SEAS) will report after the close.

Pinnacle Foods (PF), which said Tuesday that it agreed to be bought by Hillshire Brands (HSH, Fortune 500), will also report quarterly earnings before the bell.

Sony (SNE) reported full-year results showing sales rose but the firm still recorded a loss for the year. The Japanese electronics giant said a big reason behind the jump in sales was favorable foreign exchange rates. Sony shares pushed up by just over 1% in Tokyo trading.

Shares in Fossil (FOSL) fell in extended trading after the company reported a drop in quarterly profit.

In economic news, the U.S. government will publish its monthly producer price index at 8:30 a.m. ET.

The Dow Jones industrial average and S&P 500 closed at record highs again Tuesday. The S&P 500 touched 1,900 for the first time ever, while the Dow closed at about 16,715. The Nasdaq underperformed its peers, closing down about 0.3%.

European markets were mostly lower in morning trading.

Shares in GlaxoSmithKline (GLAXF) were moving down after China charged a former executive with arranging a bribery scheme.

No comments:

Post a Comment