American aerospace and defense giant Lockheed Martin (LMT) recently announced its plans of acquiring the satellite wing of Astrotech Corp. (ASTC), Astrotech Space Operations. Lockheed expects to close the deal by the third quarter of the current year. After the deal closes, Astrotech Space Operations would become the wholly owned subsidiary of Lockheed Martin and would operate under the company's Space Systems business segment.

The Deal

According to Astrotech, Lockheed Martin has made an acquisition proposal worth $61 million. But the Maryland-based company has not yet mentioned details regarding the pricing of the deal in the press release. Astrotech's headquarter is in Titusville, Florida. Its division Astrotech Space Operations' know-how lies in the area of "final stages of launch preparation", which would help balance Lockheed Martin's expertise in launching solutions with value added services, and satellite designs. Astrotech Space Operations offers launch services to commercial and government satellite, covering close to 90% of the satellite market in the U.S.

The company already has huge presence in this space with vast satellite operations, in comparison to the operations of Astrotech. But there definitely lies a good reason why Lockheed selected to acquire Astrotech, given that the company is extremely particular about businesses that it plans to takeover. In the press release Lockheed Martin mentioned that the acquisition proposal is subject to Astrotech shareholders approval.

Once that is done, the deal would close and Astrotech would become part of the aeronautics giant. Astrotech Space Operations' top bosses are quite positive about the deal, which is evident from the statement the company's Senior VP Don White made saying "joining Lockheed Martin will benefit our customers and our employees." Following the announcement of Lockheed's intension to buy the assets of the company, shares of Astrotech jumped from $2.25 to $4.59 intraday. The proceeds from the transaction would be used by the company to invest in growth areas such as developing the product line of detect mass spectrometer.

Growing Competition

The aerospace sector is increasingly becoming competitive. The acquisition proposal comes at a time when another Dulles-based industry player Orbital Sciences (ORB) plans to combine with the defense segment of Alliant Techsystems' (ATK) and emerge as a stronger new entity named Orbital ATK. The defense space has been vastly dominated by the United Launch Alliance, which is a joint venture between Chicago-based aircraft major Boeing (BA) and Lockheed Martin. However, after the $5 billion merger deal to form Orbital ATK is complete, the industry will grow more competitive.

The Astrotech deal would not add much in terms of revenue or profits to the company's financials, but it definitely portrays Lockheed's focus on developing its space operations.

Departing Thoughts

The acquisition is a tiny move made by Lockheed to strengthen its space operations, but from the point of view of Astrotech, the deal looks like a good one for its shareholders. Even Lockheed's space operations would get good support and streamline further. There have been worries regarding the cut in the U.S. defense budget in the recent past, but there's no stopping Lockheed's shares that rose more than 50% in the last one year. Overall, the deal might be a small one, but it looks like a well thought out move.

About the author:Quick PenA seasonal writer with a Management Degree in Finance and interests in automotive, technology, telecommunication and aerospace sectors.| Currently 0.00/512345 Rating: 0.0/5 (0 votes) |

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS | Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

163.65 (1y: +55%) $(function(){var seriesOptions=[],yAxisOptions=[],name='LMT',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1370235600000,105.44],[1370322000000,105.07],[1370408400000,103.59],[1370494800000,104.37],[1370581200000,107.36],[1370840400000,106.67],[1370926800000,105.96],[1371013200000,107.05],[1371099600000,107.97],[1371186000000,107.7],[1371445200000,108.27],[1371531600000,108.85],[1371618000000,106.93],[1371704400000,105.04],[1371790800000,105.06],[1372050000000,103.83],[1372136400000,103.67],[1372222800000,105.77],[1372309200000,107.36],[1372395600000,108.46],[1372654800000,108.06],[1372741200000,106.4],[1372827600000,107.2],[1373000400000,108.66],[1373259600000,109.17],[1373346000000,109.57],[1373432400000,111.52],[1373518800000,113.1],[1373605200000,112.53],[1373864400000,114.37],[1373950800000,112.6],[1374037200000,114.08],[1374123600000,115.39],[1374210000000,115.55],[1374469200000,115.65],[1374555600000,117.92],[1374642000000,119.12],[1374728400000,119.5],[1374814800000,120],[1375074000000,119.99],[1375160400000,120.09],[1375246800000,120.12],[1375333200000,122.17],[1375419600000,123.77],[1375678800000,124.15],[1375765200000,124.26],[1375851600000,124.54],[1375938000000,124.64],[1376024400000,124.02],[1376283600000,123],[1376370000000,124.06],[1376456400000,123.62],[1376542800000,122.13],[1376629200000,122.2],[1376888400000,121.91],[1376974800000,122.41],[1377061200000,122.93],[1377147600000,123.71],[1377234000000,126],[1377493200000,125.19],[1377579600000,123.14],[1377666000000,123.3],[1377752400000,122.34],[1377838800000,122.42],[1378184400000,123.63],[1378270800000,124.27],[1378357200000,124.14],[1378443600000,123.73],[1378702800000,124.07],[1378789200000,125.07],[1378875600000,126.57],[1378962000000,126.54],[1379048400000,127.25],[1379307600000,128.46],[1379394000000,129.64],[1379480400000,130.84],[1379566800000,130.39],[1379653200000,128],[1379912400000,127.62],[1379998800000,128.14],[1380085200000,127.86],[1380171600000,129.85],[1380258000000,129.24],[1380517200000,127.5! 5],[1380603600000,127.5],[1380690000000,125.08],[1380776400000,122.83],[1380862800000,122.5],[1381122000000,123.56],[1381208400000,122.46],[1381294800000,122.03],[1381381200000,126.68],[1381467600000,126.17],[1381726800000,127.5],[1381813200000,125.9],[1381899600000,127.86],[1381986000000,129.36],[1382072400000,128.9],[1382331600000,125.3],[1382418000000,130.05],[1382504400000,131.98],[1382590800000,132.62],[1382677200000,134],[1382936400000,133.23],[1383022800000,133.66],[1383109200000,133.72],[1383195600000,133.34],[1383282000000,134.55],[1383544800000,135.74],[1383631200000,135.47],[1383717600000,136.87],[1383804000000,136.2],[1383890400000,138.11],[1384149600000,137.15],[1384236000000,137.23],[1384322400000,137.26],[1384408800000,138.29],[1384495200000,137.45],[1384754400000,137.85],[1384840800000,138.97],[1384927200000,137.19],[1385013600000,138.67],[1385100000000,140.88],[1385359200000,141.76],[1385445600000,143.06],[1385532000000,143.94],[1385704800000,141.67],[1385964000000,139.7],[1386050400000,138.77],[13861368

163.65 (1y: +55%) $(function(){var seriesOptions=[],yAxisOptions=[],name='LMT',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1370235600000,105.44],[1370322000000,105.07],[1370408400000,103.59],[1370494800000,104.37],[1370581200000,107.36],[1370840400000,106.67],[1370926800000,105.96],[1371013200000,107.05],[1371099600000,107.97],[1371186000000,107.7],[1371445200000,108.27],[1371531600000,108.85],[1371618000000,106.93],[1371704400000,105.04],[1371790800000,105.06],[1372050000000,103.83],[1372136400000,103.67],[1372222800000,105.77],[1372309200000,107.36],[1372395600000,108.46],[1372654800000,108.06],[1372741200000,106.4],[1372827600000,107.2],[1373000400000,108.66],[1373259600000,109.17],[1373346000000,109.57],[1373432400000,111.52],[1373518800000,113.1],[1373605200000,112.53],[1373864400000,114.37],[1373950800000,112.6],[1374037200000,114.08],[1374123600000,115.39],[1374210000000,115.55],[1374469200000,115.65],[1374555600000,117.92],[1374642000000,119.12],[1374728400000,119.5],[1374814800000,120],[1375074000000,119.99],[1375160400000,120.09],[1375246800000,120.12],[1375333200000,122.17],[1375419600000,123.77],[1375678800000,124.15],[1375765200000,124.26],[1375851600000,124.54],[1375938000000,124.64],[1376024400000,124.02],[1376283600000,123],[1376370000000,124.06],[1376456400000,123.62],[1376542800000,122.13],[1376629200000,122.2],[1376888400000,121.91],[1376974800000,122.41],[1377061200000,122.93],[1377147600000,123.71],[1377234000000,126],[1377493200000,125.19],[1377579600000,123.14],[1377666000000,123.3],[1377752400000,122.34],[1377838800000,122.42],[1378184400000,123.63],[1378270800000,124.27],[1378357200000,124.14],[1378443600000,123.73],[1378702800000,124.07],[1378789200000,125.07],[1378875600000,126.57],[1378962000000,126.54],[1379048400000,127.25],[1379307600000,128.46],[1379394000000,129.64],[1379480400000,130.84],[1379566800000,130.39],[1379653200000,128],[1379912400000,127.62],[1379998800000,128.14],[1380085200000,127.86],[1380171600000,129.85],[1380258000000,129.24],[1380517200000,127.5! 5],[1380603600000,127.5],[1380690000000,125.08],[1380776400000,122.83],[1380862800000,122.5],[1381122000000,123.56],[1381208400000,122.46],[1381294800000,122.03],[1381381200000,126.68],[1381467600000,126.17],[1381726800000,127.5],[1381813200000,125.9],[1381899600000,127.86],[1381986000000,129.36],[1382072400000,128.9],[1382331600000,125.3],[1382418000000,130.05],[1382504400000,131.98],[1382590800000,132.62],[1382677200000,134],[1382936400000,133.23],[1383022800000,133.66],[1383109200000,133.72],[1383195600000,133.34],[1383282000000,134.55],[1383544800000,135.74],[1383631200000,135.47],[1383717600000,136.87],[1383804000000,136.2],[1383890400000,138.11],[1384149600000,137.15],[1384236000000,137.23],[1384322400000,137.26],[1384408800000,138.29],[1384495200000,137.45],[1384754400000,137.85],[1384840800000,138.97],[1384927200000,137.19],[1385013600000,138.67],[1385100000000,140.88],[1385359200000,141.76],[1385445600000,143.06],[1385532000000,143.94],[1385704800000,141.67],[1385964000000,139.7],[1386050400000,138.77],[13861368

How BlackBerry fell so fast NEW YORK (CNNMoney) Who isn't on the list of rumored potential BlackBerry suitors that surfaced this weekend?

How BlackBerry fell so fast NEW YORK (CNNMoney) Who isn't on the list of rumored potential BlackBerry suitors that surfaced this weekend?  NEW YORK (CNNMoney) It's been quite the climb for the stock market in recent days, but investors stopped to take breath Wednesday.

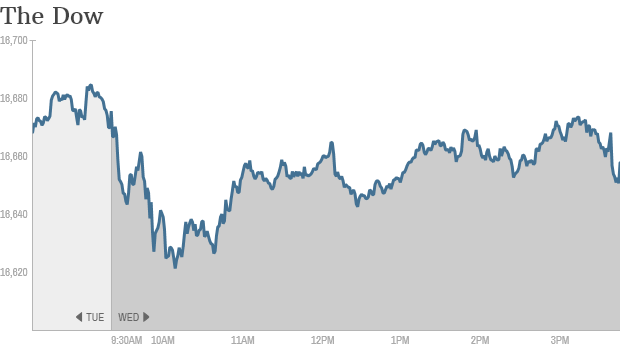

NEW YORK (CNNMoney) It's been quite the climb for the stock market in recent days, but investors stopped to take breath Wednesday.  Tesla debt: An electric lemon?

Tesla debt: An electric lemon?  Bloomberg

Bloomberg  Alamy Microsoft CEO Steve Ballmer is heading for the exit. Should Microsoft (MSFT) shareholders follow suit? Shares of the software giant soared 7 percent on Friday on news that it would be replacing Ballmer as CEO within the next 12 months. The market's opinion of the news must sting Ballmer (though it also made him a few hundred million dollars richer), but investors expecting that Microsoft's next leader will be able to return the company to its former glory may be in for a rude awakening. Why would consumers and businesses want to return to a time when they were dependent on a stodgy operating system that was expensive and slow to adapt? What if Microsoft doesn't find the right CEO? What if there is no such thing as the CEO? Those are just a few of the heavy questions that Microsoft's stockholders face in light of Ballmer's pending departure, and they may not like the answers. You Can't Go Home Again First, let's talk fundamentals. Does Microsoft's business make it a good buy for forward-thinking investors? Well, in the past dozen years, Microsoft has gone from being the world's most valuable company to one that is worth less than two-thirds of what current leader Apple (AAPL) is today. Microsoft and Google (GOOG) commanded nearly identical $290 billion market caps at the kick off of this trading week, and the search engine giant wasn't even publicly traded when Ballmer was tapped to be Microsoft's CEO in 2000. In fact, Google had only been founded 16 months earlier. Tech babies grow so fast these days. And that, at least in part, is the root of Microsoft's problems. Computing hasn't merely evolved -- it has metamorphosed. Consumers aren't buying PCs like they used to. Desktop and laptop sales have fallen sharply for five consecutive quarters, which has never happened before. That's not a lull. That's not a bad stretch. That's a trend. And it isn't just a Windows woe. Apple's Mac sales have also been sliding in recent quarters. Most PC buyers never needed the full processing power their machines had under the hood, and that's even more true today. A large percentage of us just want to surf the Web, check email, and stream media. We don't need a desktop or laptop for that; all we need is an Internet connection. We live in a world of mobile apps and browser-based software, which increasingly means means that we can be operating system agnostic: Windows, iOS, Android, Linux -- it all looks and feels mostly the same once you get started. Those are painful shifts for Microsoft: Its two primary cash cows are its Windows operating system and its Office productivity suite. Windows has only managed to claw out a 4 percent share of the market in smartphones and tablets, and that's after throwing billions of dollars at mobile computing. Google's Android has become the operating system of choice for smartphone and tablet users, and Apple's iOS is a distant second worldwide. That leaves Microsoft with a nearly insurmountable amount of ground to make up, even assuming it can figure out how to compete with the freely available open-source Android. Microsoft used to command premium prices for its Windows updates; soon, it may not even be able to give them away. The outlook for Microsoft Office is a bit more secure, largely because Google's competing cloud-based software hasn't exactly stormed the market -- yet. However, it's really just a matter of time before the productivity business succumbs to the allure of free, cloud-based applications. The Good News And yes, there some good news. Microsoft is still growing despite the headwinds. Server and tools software products continue to sell briskly. Microsoft's Xbox 360 has been the country's top gaming console for months, and after a few initial missteps, excitement is building for November's debut of Xbox One. Bing has been able to hold its own in search, fortified by a deal struck with Yahoo (YHOO) to handle the dot-com pioneer's search business. Microsoft is growing overall, and analysts see revenue and earnings per share climbing in the 4 percent to 6 percent range in fiscal 2014. The tech bellwether isn't reeling, but it's certainly not growing fast enough to satisfy today's growth stock investors. Meet the New Boss ... Finally, let's talk leadership. We can safely assume that Microsoft won't hire its next CEO from the inside. Promoting from within is often a smart move, but investors didn't send Microsoft's stock $20 billion higher in value because they hoped Ballmer was going to be replaced by someone already helping call the shots in Redmond. Microsoft is going to need a seasoned outsider with a big name, and don't be surprised if it's a former Google or Apple executive. Hiring Google execs has worked well for many of the Internet's meandering companies. Yahoo shares have nearly doubled in value since ex-Googler Marissa Mayer took over 13 months ago. Facebook (FB) certainly hasn't suffered since Sheryl Sandberg stepped in as COO. Then we have Apple. Executives from the iEverything company used to be untouchable, but a slumping share price since last October's iPhone 5 release and a corporate shake-up shortly after that could drive a big name from Apple to accept the Microsoft challenge. So Microsoft may actually wind up with a name that the market likes, which could give it a short-term bounce -- but that still doesn't mean that you buy Microsoft here. No matter who is running the show, its attempted transformation from a software dynamo into a tech firm that specializes in products and services will be long, expensive, and likely unsuccessful. Microsoft isn't going away: It has far too much money. However, it hasn't been able to buy or build its way into relevance in the markets that are growing. The ultimate question for investors here is, will Microsoft will be more relevant in five years than it is now? You can hope for a transformational figure as its next CEO, but deep down inside, you know the answer.

Alamy Microsoft CEO Steve Ballmer is heading for the exit. Should Microsoft (MSFT) shareholders follow suit? Shares of the software giant soared 7 percent on Friday on news that it would be replacing Ballmer as CEO within the next 12 months. The market's opinion of the news must sting Ballmer (though it also made him a few hundred million dollars richer), but investors expecting that Microsoft's next leader will be able to return the company to its former glory may be in for a rude awakening. Why would consumers and businesses want to return to a time when they were dependent on a stodgy operating system that was expensive and slow to adapt? What if Microsoft doesn't find the right CEO? What if there is no such thing as the CEO? Those are just a few of the heavy questions that Microsoft's stockholders face in light of Ballmer's pending departure, and they may not like the answers. You Can't Go Home Again First, let's talk fundamentals. Does Microsoft's business make it a good buy for forward-thinking investors? Well, in the past dozen years, Microsoft has gone from being the world's most valuable company to one that is worth less than two-thirds of what current leader Apple (AAPL) is today. Microsoft and Google (GOOG) commanded nearly identical $290 billion market caps at the kick off of this trading week, and the search engine giant wasn't even publicly traded when Ballmer was tapped to be Microsoft's CEO in 2000. In fact, Google had only been founded 16 months earlier. Tech babies grow so fast these days. And that, at least in part, is the root of Microsoft's problems. Computing hasn't merely evolved -- it has metamorphosed. Consumers aren't buying PCs like they used to. Desktop and laptop sales have fallen sharply for five consecutive quarters, which has never happened before. That's not a lull. That's not a bad stretch. That's a trend. And it isn't just a Windows woe. Apple's Mac sales have also been sliding in recent quarters. Most PC buyers never needed the full processing power their machines had under the hood, and that's even more true today. A large percentage of us just want to surf the Web, check email, and stream media. We don't need a desktop or laptop for that; all we need is an Internet connection. We live in a world of mobile apps and browser-based software, which increasingly means means that we can be operating system agnostic: Windows, iOS, Android, Linux -- it all looks and feels mostly the same once you get started. Those are painful shifts for Microsoft: Its two primary cash cows are its Windows operating system and its Office productivity suite. Windows has only managed to claw out a 4 percent share of the market in smartphones and tablets, and that's after throwing billions of dollars at mobile computing. Google's Android has become the operating system of choice for smartphone and tablet users, and Apple's iOS is a distant second worldwide. That leaves Microsoft with a nearly insurmountable amount of ground to make up, even assuming it can figure out how to compete with the freely available open-source Android. Microsoft used to command premium prices for its Windows updates; soon, it may not even be able to give them away. The outlook for Microsoft Office is a bit more secure, largely because Google's competing cloud-based software hasn't exactly stormed the market -- yet. However, it's really just a matter of time before the productivity business succumbs to the allure of free, cloud-based applications. The Good News And yes, there some good news. Microsoft is still growing despite the headwinds. Server and tools software products continue to sell briskly. Microsoft's Xbox 360 has been the country's top gaming console for months, and after a few initial missteps, excitement is building for November's debut of Xbox One. Bing has been able to hold its own in search, fortified by a deal struck with Yahoo (YHOO) to handle the dot-com pioneer's search business. Microsoft is growing overall, and analysts see revenue and earnings per share climbing in the 4 percent to 6 percent range in fiscal 2014. The tech bellwether isn't reeling, but it's certainly not growing fast enough to satisfy today's growth stock investors. Meet the New Boss ... Finally, let's talk leadership. We can safely assume that Microsoft won't hire its next CEO from the inside. Promoting from within is often a smart move, but investors didn't send Microsoft's stock $20 billion higher in value because they hoped Ballmer was going to be replaced by someone already helping call the shots in Redmond. Microsoft is going to need a seasoned outsider with a big name, and don't be surprised if it's a former Google or Apple executive. Hiring Google execs has worked well for many of the Internet's meandering companies. Yahoo shares have nearly doubled in value since ex-Googler Marissa Mayer took over 13 months ago. Facebook (FB) certainly hasn't suffered since Sheryl Sandberg stepped in as COO. Then we have Apple. Executives from the iEverything company used to be untouchable, but a slumping share price since last October's iPhone 5 release and a corporate shake-up shortly after that could drive a big name from Apple to accept the Microsoft challenge. So Microsoft may actually wind up with a name that the market likes, which could give it a short-term bounce -- but that still doesn't mean that you buy Microsoft here. No matter who is running the show, its attempted transformation from a software dynamo into a tech firm that specializes in products and services will be long, expensive, and likely unsuccessful. Microsoft isn't going away: It has far too much money. However, it hasn't been able to buy or build its way into relevance in the markets that are growing. The ultimate question for investors here is, will Microsoft will be more relevant in five years than it is now? You can hope for a transformational figure as its next CEO, but deep down inside, you know the answer.

Popular Posts: 5 Crash-Proof Dividend Stocks9 Cheap Stocks to Buy Now for $10 or LessTesla Stock Could Fall Even Lower on Battery Boondoggle Recent Posts: 5 High-Growth Stocks to Believe In 3 Businesses That Millennials Are Destroying Will Fisker’s Billionaire Owner Put a Dent in Tesla Stock? View All Posts

Popular Posts: 5 Crash-Proof Dividend Stocks9 Cheap Stocks to Buy Now for $10 or LessTesla Stock Could Fall Even Lower on Battery Boondoggle Recent Posts: 5 High-Growth Stocks to Believe In 3 Businesses That Millennials Are Destroying Will Fisker’s Billionaire Owner Put a Dent in Tesla Stock? View All Posts  Whether it be the flame-out of biotech stocks earlier in the year, the meltdown in trendy sectors like cloud computing or 3D printing companies, or just the crash of big tech names, it's clear that the pain can be just as acute as the gain in momentum stocks. All it takes is a change in direction, and momentum works against investors in a big way.

Whether it be the flame-out of biotech stocks earlier in the year, the meltdown in trendy sectors like cloud computing or 3D printing companies, or just the crash of big tech names, it's clear that the pain can be just as acute as the gain in momentum stocks. All it takes is a change in direction, and momentum works against investors in a big way. Surprised that Visa (V), the payments processor that has been a household name for decades, is a high-growth stock?

Surprised that Visa (V), the payments processor that has been a household name for decades, is a high-growth stock? Sure, Amazon (AMZN) has hit a serious wall in 2014 as momentum has crumbled. Shares of AMZN stock are down more than 20% year-to-date, and investors are finally showing serious concerns about whether Amazon is committed to growing profits instead of simply growing sales.

Sure, Amazon (AMZN) has hit a serious wall in 2014 as momentum has crumbled. Shares of AMZN stock are down more than 20% year-to-date, and investors are finally showing serious concerns about whether Amazon is committed to growing profits instead of simply growing sales. Unlike Amazon, Facebook (FB) has actually outperformed nicely in 2014; The stock is up about 8% vs. a flat S&P 500.

Unlike Amazon, Facebook (FB) has actually outperformed nicely in 2014; The stock is up about 8% vs. a flat S&P 500. Priceline.com (PCLN) is one of those Internet stocks that many investors talk about, and many investors are afraid of thanks to volatility and steep valuation.

Priceline.com (PCLN) is one of those Internet stocks that many investors talk about, and many investors are afraid of thanks to volatility and steep valuation. Keeping with the Internet theme, Baidu (BIDU) should be no stranger to momentum investors out there. The stock has long been crowed about as being the "next Google (GOOG)" because of its dominance in Chinese search and advertising, among other things.

Keeping with the Internet theme, Baidu (BIDU) should be no stranger to momentum investors out there. The stock has long been crowed about as being the "next Google (GOOG)" because of its dominance in Chinese search and advertising, among other things.