Tata Consultancy Services�created history on Friday as it touched a fresh record high above Rs 1,900 per share, supported by expectations of strong growth in the June quarter and depreciation in the rupee against the dollar.

The IT bellwether hit a fresh record high of Rs 1,916.15 per share on the BSE. The stock has been in an uptrend in 2018, up over 40 percent in the first six months. Indian largest software exporter holds the tag of India��s most valued company with a market capitalisation of Rs 7.2 lakh crore, followed by Reliance Industries, HDFC Bank, ITC, and HDFC.

TCS reported a 5.7 percent sequential rise in net profit in its fourth quarter to Rs 6,904 crore, beating analyst expectations in the March quarter. Revenue for the quarter rose 3.8 percent sequentially to Rs 32,075 crore for the quarter-ended March 31.

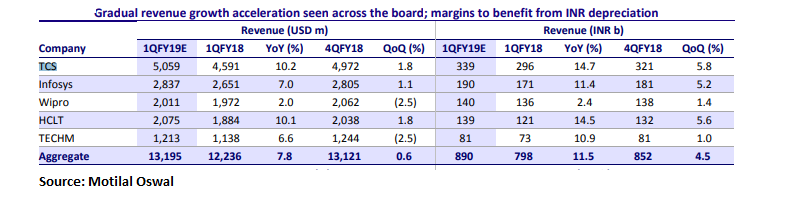

Brokerages expect over 3 percent sequential growth for the June quarter, above peers such as Infosys and HCL Technologies.

related news D-Street Buzz: Auto stocks rally with Tata Motors, Hero Moto up 3-4%; Asian Paints hits new 52-week high, Adani Power spikes Over 160 stocks hit fresh 52-week low on BSE; DEN Networks, Hathway, BHEL, Andhra Bank top losers Kotak Securities upgrades Ashok Leyland to buy; slowdown concerns is overdoneJefferies said TCS may report a 3.8 percent quarter-on-quarter constant currency growth in Q1. It added that Wipro and Tech Mahindra may lag with just 1-1.2 percent decline and Infosys and HCL Technologies in between. ��The cross-currency impact should drag reported QoQ dollar growth by another 90-150 bps. The weakness in margin on wage hike and visa costs should be offset by depreciation in the rupee.��

TCS, which alone constitutes to 40 percent of the sector��s profit after tax, will derive 60 percent of incremental profits in Q1 FY19, it estimated. ��Bottoming cyclical pressures and improved capital allocation are factors that will feed into valuation multiples favourably, whereas currency keeps earnings growth ticking further.��

Motilal Oswal said in a recent report that barring banking and financial services and retail, all segments for TCS were growing in healthy single or double-digits, on the back of revival in retail and a slew of large deal announcements ��We expect 3.3% QoQ CC growth in Q1. This signifies an acceleration compared to the 2 percent QoQ CC growth witnessed in Q4 FY18.��

First Published on Jul 6, 2018 01:01 pm

First Published on Jul 6, 2018 01:01 pm

No comments:

Post a Comment