The US auto market saw a very strong sales month in June. Sales came in close to 17.5 million (SAAR) with strong demand in the SUV and truck segments. Ford (F) was able to present investors with another month of rock-solid sales, which is a good representation of the current economic environment. Source: Ford

Source: Ford

One of the reasons why I spend quite some time studying monthly sales statistics is to figure out what the consumer is up to. The car is the ultimate consumer product, which simply means that a good economy supports higher sales while a slower economy pushes sales down. In addition to that, we have been seeing a massive trend from cars to trucks and SUVs supported by lower gas prices and an overall solid economy.

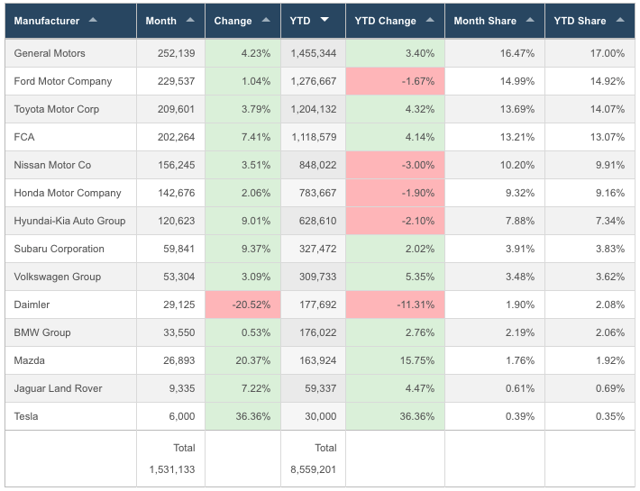

The first overview shows that the US auto market did quite well in June. All major manufacturers were able to grow sales in June with the exception of Daimler (OTCPK:DDAIF), the owner of Mercedes-Benz. It is also quite impressive that 4 out of 5 top-selling companies were able to grow sales by more than 3.5%. Furthermore, it is important to mention that GM (NYSE:GM), Toyota (NYSE:TM) and Fiat Chrysler (NYSE:FCAU) were able to grow sales on a YTD basis (all more than 3.0%).

Source: Goodcarbadcar

Source: Goodcarbadcar

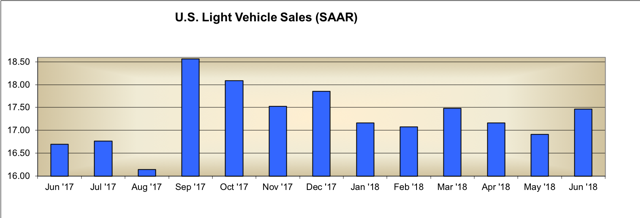

Even more important is that the total seasonally adjusted annual rate is up from slightly less than 17 million in May to currently 17.48 million. This is the highest level since December of 2017 when sales hit 17.85 million units. Note that I am ignoring the March 2018 number, which was just 10,000 units above the current reading.

Source: Motor Intelligence

Source: Motor Intelligence

Not only is it important for the automotive industry to get sales up into the high 17 million range, it is also important for the outlook of many suppliers. Especially steel producers have forecasted sales in the lower 17 million range.

AK Steel (NYSE:AKS), for example, is expecting 17.2 million cars to be produced in 2018 as you can read in its first-quarter earnings transcript provided by Seeking Alpha.

Every reading close to 18 million would be a huge tailwind for these companies as well as automotive manufacturers (obviously).

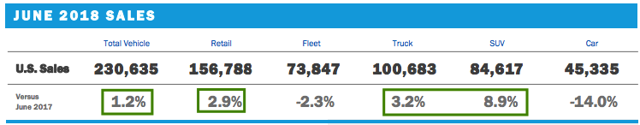

That being said, Ford did really well in June.

Trucks, SUVs & LincolnFord's June sales are up 1.2%. This is 0.5 point above last month's growth rate, which is entirely due to higher truck and SUV sales. Car sales growth actually decreased another 0.7 point. Current car sales are less than half of total truck sales. Also note that fleet sales were down slightly which is due to the timing of orders. It is important to mention that Ford is not pushing fleet sales. The company is adapting its sales to customer needs, which causes fleet sales to fluctuate a lot.

Source: Ford Sales Report June 2018

Source: Ford Sales Report June 2018

Total truck sales increased 3.2%. This includes a 1.7% increase of F-150 sales which pushes YTD sales up to 4.9%. However, Transit sales massively outperformed with 25.0% growth to more than 13,500 units. YTD Transit sales are currently up 7.5%, which shows the real success of the transit as I already mentioned in last month's article. Capital expenditures remain high which results in higher Transit sales. On a side note, heavy trucks saw a 35.1% sales increase to 1,098 units.

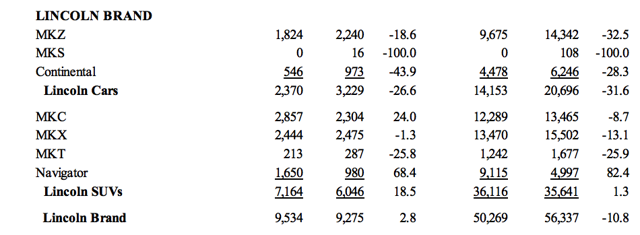

But that's not everything. Lincoln did really well in June. Yes, Lincoln cars were a total mess with sales being down 31.6% YTD. However, Lincoln SUVs are gaining momentum. Both the MKC and Navigator did really well with sales growth numbers of 24.0% and 68.4%. The Navigator is up 82.4% YTD, which is a confirmation of the strength of the new Navigator model. And it's not just the 'regular' Navigator. Customers are increasingly buying the Black Label model which caused the average Navigator ticket price to soar $27,000, according to Ford. The same goes for the F-150 model which has an average selling price of $46,800.

Source: Ford Sales Report June 2018

Source: Ford Sales Report June 2018

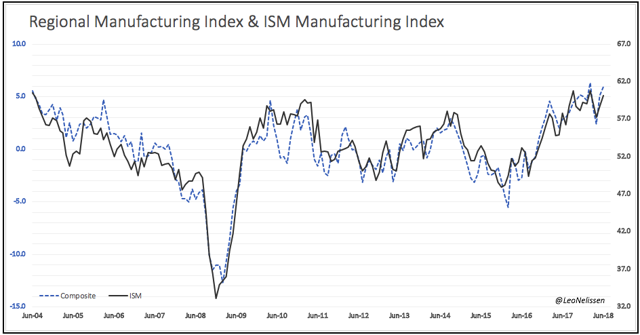

One of the things auto manufacturers look at is the leading indicator, the ISM manufacturing index (graph below). This index massively beat estimates in June as I discussed in this article. This means that the general economy remains in a stage of above-average growth, which stimulates both consumer spending and capital expenditures.

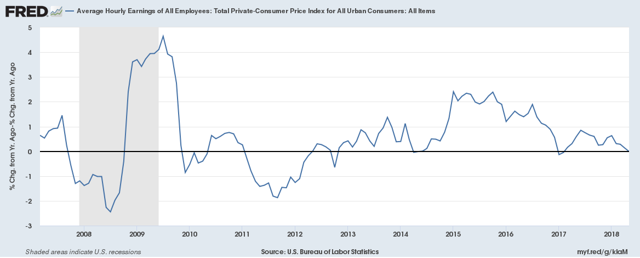

That being said, I also look at the difference between average hourly earnings growth and the consumer price index to see if the trend from cars to SUVs and trucks might be in danger. It is clearly visible that consumers did benefit from outperforming earnings growth between 2015 and 2017. The trend from cars to bigger vehicles started during this period.

That being said, I also look at the difference between average hourly earnings growth and the consumer price index to see if the trend from cars to SUVs and trucks might be in danger. It is clearly visible that consumers did benefit from outperforming earnings growth between 2015 and 2017. The trend from cars to bigger vehicles started during this period.

That's why I am getting a bit cautious at this point. I am not turning bearish on truck and SUV sales, but think that is important to see if we get signs of an ending trend in case inflation starts outperforming hourly earnings growth. The same happened in 2008 and can be considered a typical late-cycle occurrence.

Takeaway

Takeaway There are two things I am getting from the current sales report.

The automotive market seems to be strengthening SUVs, trucks and commercial vehicles continue to do very wellI think that everything I have read so far is a clear confirmation of the economic trend we are in. Growth is strong and people desperately want to buy the cars they like. This includes bigger vehicles as well as more expensive versions of models like the F-150 and Navigator. None of these things are visible during an economic growth slowing trend.

However, it is important to further monitor these sales, especially given that inflation and commodities in general are showing typical late-cycle behaviour.

And last but not least, I hope to see that sales continue to be close to the 18 million SAAR level over the next few months, which would beat a lot of expectations as I mentioned in this article.

Stay tuned!

Thank you for reading my article. Please let me know what you think of my thesis. Your input is highly appreciated!

Disclosure: I am/we are long F.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.

No comments:

Post a Comment