Good(ish) news came out last week: Americans now have a record net worth of more than $70 trillion, surpassing the old peak set in 2007.

Sort of, anyway. As my colleague John Maxfield pointed out, adjust the figure for inflation, and we're still poorer than we were six years ago.

You can take this several steps further. Adjust household net worth for both inflation and population growth, and we're still a good 15% below the peak:

Source: Federal Reserve, author's calculations.

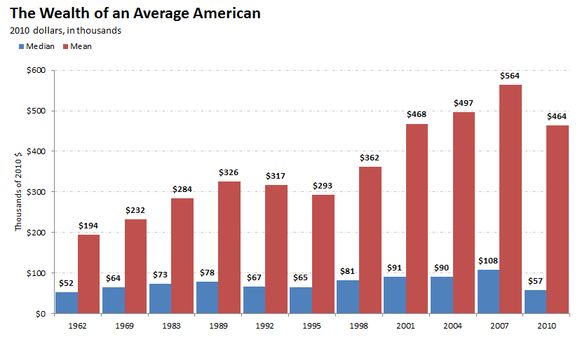

More importantly, America's wealth is highly skewed. Looking at aggregate wealth per person doesn't tell a fraction of the true story. Wal-Mart has 263,499 common shareholders, but just seven members of the Walton family own 50.9% of the company. That's an extreme example, but it's a reminder that the median (the middle level) is more revealing than the mean average.

New York University economist Edward Wolff has calculated the median net worth of American households going back half a century. It's depressing. As of 2010, inflation-adjusted median net worths were at the lowest level since the 1960s:

Source: Edward Wolff.

A lot has changed for the better since 2010 -- unemployment is lower, and the Dow Jones (DJINDICES: ^DJI ) has increased 50%. More current figures would likely be a bit less grim. But probably not much. As Wolff shows, the median household have most of their net worth in their home. Median non-home wealth -- the kind that benefits from a booming stock market -- was pitifully low in 2010, easily the lowest in half a century. And the percentage of Americans with zero or negative net worth sat at an all-time high:

Source: Edward Wolff.

Wolff shows that the middle three quintiles of American households have only about 17% of their net worth in pensions, mutual funds, and stocks. A 50% stock market rally, in other words, hasn't likely done much to boost these figures since 2010.

Forget about averages. We're a nation of multiple truths. The economy is prospering, but most Americans aren't. Stocks are at an all-time high, but most Americans' portfolios aren't. America is richer than ever, but most Americans aren't. Some call this the "two-speed" recovery. Whatever it is, it hurts.

No comments:

Post a Comment