Innovative Industrial Properties (IIPR) is breaking out higher following continued expansion in the company's operations. As the medical cannabis industry grows in the U.S., IIPR is at the forefront of providing cultivation and processing facilities to such companies. As regulation is rolled back on medical cannabis, its share price has trended higher, currently trading near record levels. I am buying stock in this name as it presents a first mover advantage in the burgeoning industry.

Fundamental NarrativeIIPR is an attractive buy at current levels due to the expanding scope of the legalized medical cannabis industry in the U.S., as well as the company being at the forefront of the REIT industry in this category.

The company is a self-advised Maryland corporation focused on the acquisition, ownership and management of specialized industrial properties leased to experienced, state-licensed operators for their regulated medical-use cannabis facilities.

At the end of the most recent quarter, IIPR owned five properties in four states, totaling approximately 617,000 square feet, which were 100% leased on a long-term basis to high quality licensed, medical-use cannabis operators, according to its earnings call. Its initial blended yield on these properties is 15.8% with each lease providing minimum annual escalations ranging from 3.25% to 4%.

The company is very active in terms of acquisitions as they continuously look for opportunities in this growing industry. In December, they closed on a sale-leaseback transaction for a 358,000 square-foot medical-use cannabis cultivation and processing facility with a farm in Arizona and closed on two other sale-leaseback transactions with Vireo in the state of New York, as well as Minnesota in October and November, according to its earnings call.

The medical-use cannabis industry is constantly evolving, including strong growth of existing state markets and the rollout of new programs passed to numerous states by popular vote or legislation in recent years.

Within the nascent industry, management is witnessing amazing growth with state regulated medical-use cannabis markets now comprising a large majority of the United States. Congress has enacted spending bills since 2014 with a provision that has been interpreted by courts as preventing the Department of Justice from using funds to interfere with the implementation of state medical-use cannabis laws, aiding IIPR's ultimate growth effort.

The provision was again included in the congressional spending bill enacted on March 23rd, which carry through September 30 of 2018, according to management. This signals that the Federal Government is largely stepping out of the way of the industry as many of the medical cannabis studies have shown to address the needs of a number of important ailments.

The company's current markets are in New York, Arizona, Maryland, and Minnesota, where they have five properties located, with continued potential in each. IIPR is seeing a lot of encouraging signs with both growth and regulation rollback in New York.

The company purchased its first New York property in December 2016 with PharmaCann for a 15-year initial term and are all in initial yield of about 17% on a triple net basis, according to its earnings call. PharmaCann is a multistate operator with two cultivation facilities and four medical-use cannabis dispensers in Illinois, as well as IIPR's cultivation facility in four medical-use cannabis dispensaries in New York.

In order to enable broader access to treatment, New York has taken several positive steps including expansion of the pool of potential recommending health professionals to include nurse practitioners and physician assistants, allowing for home delivery of the medicine, the streamlining of the registration process for practitioners and certification process for patients and perhaps most importantly the introduction of chronic pain and PTSD as additional qualifying condition, according to its earnings call.

The market potential and estimated overall size of the illicit market in New York is nearly $3 billion, with an estimated $254 million of sales in New York's legal market by 2021, representing a compounded annual growth rate from 2016 of 48%, signaling the large growth potential for IIPR and its partners.

Its partner in Arizona, Pharma, is one of the largest wholesalers of medical-use cannabis in the Arizona market, with a highly experienced multidisciplinary management team that is well positioned to grow the Pharma's market share in Arizona and facilitate expansion into other states, according to its earnings call. Arizona's medical-use cannabis program is further along and mature than New York, having commenced medical-use cannabis sales in 2010.

According to the Arizona Department of Health Services, there are over 150,000 qualifying patients in the Arizona's medical cannabis program as of February 2018, representing an increase of over 30% year-over-year with over 85% of registered patients utilizing medical cannabis to treat chronic pain, according to its earnings call.

Moreover, in Maryland, although it's still in its very early stages with the first dispensary opened in late 2017, management is optimistic regarding the development of the legal medical-use cannabis market, driven by Maryland's population size and anticipated demand, the inclusion of PTSD in chronic pain among the initial qualifying conditions and the general view from regulators and policymakers that the industry represents an economic development opportunity, according to management.

Within its acquisition pipeline, IIPR is focused on investing the proceeds from its recently completed follow-on common stock offering in high quality assets and top tiered tenants. In the first quarter, management executed agreements to purchase two properties for a total investment of $10.5 million.

In addition, they executed two nonbinding letters of intent for two properties representing a total expected additional investment of approximately $25 million to $30 million with final amounts determined after they complete its review, signaling the growth prospects for the company. Management is actively evaluating its pipeline of approximately $100 million in additional acquisitions spanning numerous states that have approved medical-use cannabis programs.

With regards to California, management is engaged in numerous discussions with high-quality cultivators there. As with any emerging dynamic high growth industry, IIPR is developing its acquisition strategy and criteria accordingly.

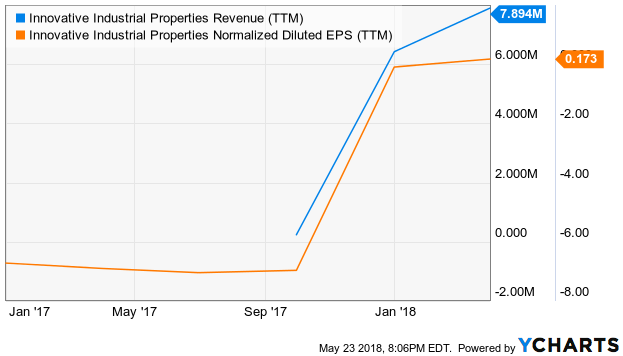

Below is a chart of the company's revenue and earnings per share. Over the last few months, IIPR's revenue has risen substantially, while its EPS is in positive territory. With management's continued focus of expansion alongside more states legalizing medical cannabis, the company's operations look primed to continue growing both on the top and bottom line.

The company's share price has traded higher since its IPO, with recent strength on its strong earnings announcement. Advancements in the medical cannabis industry, as well as deregulation in many states have aided the company's share price in recent months. The company is actively looking to expand into new properties as opportunities arise.

Its share price is breaking out to record highs, following a recent consolidation over the last few months. Breaking above the $34 level is significant as it had acted as strong resistance in recent months. The continued expansion of this industry should fuel the company's share price higher in coming quarters.

IIPR is breaking out higher following continued expansion in the company's operations. As the medical cannabis industry grows in the U.S., IIPR is at the forefront of providing cultivation and processing facilities to such companies. As regulation is rolled back on medical cannabis, its share price has trended higher, currently trading near record levels. I am buying stock in this name as it presents a first mover advantage in the burgeoning industry.

Disclosure: I am/we are long IIPR.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment