DELAFIELD, Wis. (Stockpickr) -- Trading stocks that trigger major breakouts can lead to massive profits. Once a stock trends to a new high or takes out a prior overhead resistance point, then it's free to find new buyers and momentum players who can ultimately push the stock significantly higher.

One example of a successful breakout trade I flagged recently was biotechnology player Codexis (CDXS), which I featured in July 28's "5 Stocks Ready for Breakouts" at around $1.95 per share. I mentioned in that piece that shares of Codexis were starting to uptrend again after the stock recently gapped up sharply higher from $1.38 to $2.65 with monster upside volume. That uptrend was quickly pushing shares of CDXS within range of triggering a big breakout trade above some key near-term overhead resistance levels at $1.98 to $2 a share.

Read More: Warren Buffett's Top 10 Dividend Stocks

Guess what happened? Shares Codexis triggered that breakout on July 30 with strong upside volume flows. volume on that day registered 1.18 million shares, which is well above its three-month average action of 209,570 shares. Shares of CDXS soared and tagged an intraday high during that trading session of $2.20 a share. That represents a solid gain of around 20% for anyone who bought the stock near or under $2 a share in anticipation of that breakout. Shares of CDXS still look poised to move higher, so traders should now look for the stock to take out $2.20 a share with strong upside volume flows.

Breakout candidates are something that I tweet about on a daily basis. I frequently tweet out high-probability setups, breakout plays and stocks that are acting technically bullish. These are the stocks that often go on to make monster moves to the upside. What's great about breakout trading is that you focus on trend, price and volume. You don't have to concern yourself with anything else. The charts do all the talking.

Trading breakouts is not a new game on Wall Street. This strategy has been mastered by legendary traders such as William O'Neal, Stan Weinstein and Nicolas Darvas. These pros know that once a stock starts to break out above past resistance levels and hold above those breakout prices, then it can easily trend significantly higher.

Read More: 5 Breakout Stocks Under $10 Set to Soar

With that in mind, here's a look at five stocks that are setting up to break out and trade higher from current levels.

Zhaopin

One staffing and outsourcing services player that's starting to move within range of triggering a near-term breakout trade is Zhaopin (ZPIN), which provides online recruitment services in the People's Republic of China. This stock hasn't done much so far over the last month, with shares down modestly by 3.5%.

If you take a look at the chart for Zhaopin, you'll notice that this stock has been uptrending a bit for the last few weeks, with shares moving higher from its low of $12.39 to its recent high of $14.90 a share. During that uptrend, shares of ZPIN have been making mostly higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of ZPIN within range of triggering a near-term breakout trade above some key overhead resistance levels.

Traders should now look for long-biased trades in ZPIN if it manages to break out above some near-term overhead resistance levels at $14.90 to around $15 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average volume of 528,211 shares. If that breakout triggers soon, then ZPIN will set up to re-test or possibly take out its next major overhead resistance levels at $15.73 to its all-time high at $16.70 a share. Any high-volume move above those levels will then give ZPIN a chance to make a run at $20 a share.

Read More: 8 Stocks George Soros Is Buying

Traders can look to buy ZPIN off weakness to anticipate that breakout and simply use a stop that sits right around near-term support levels at $13.75 or at $13.20 to $13 a share. One can also buy ZPIN off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

OmniVision Technologies

A semiconductor player that's quickly moving within range of triggering a big breakout trade is OmniVision Technologies (OVTI), which designs, develops, manufactures and markets semiconductor image-sensor devices worldwide. This stock is off to a strong start so far in 2014, with shares up substantially by 35%.

If you take a look at the chart for OmniVision Technologies, you'll notice that this stock bounced sharply higher on Friday right off its 50-day moving average of $22.27 a share with decent upside volume. This move also pushed shares of OVTI into breakout territory, since the stock took out some near-term overhead resistance at $22.92 a share. Shares of OVTI are now starting to move within range of trigger another big breakout trade above some key near-term overhead resistance levels.

Traders should now look for long-biased trades in OVTI if it manages to break out above some near-term overhead resistance levels at $24 to its 52-week high at $24.20 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average action of 1.14 million shares. If that breakout kicks off soon, then OVTI will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $28 to $30 a share, or even north of $30 a share.

Read More: Must-See Charts: 5 Big Stocks to Buy for Tactical Gains

Traders can look to buy OVTI off weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average of $22.27 a share or around $21 a share. One could also buy OVTI off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Bluebird Bio

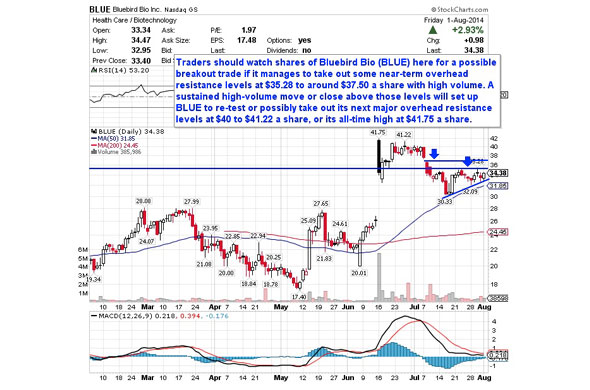

A biotechnology player that's starting to trend within range of triggering a near-term breakout trade is Bluebird Bio (BLUE), which focuses on developing gene therapies for severe genetic and orphan diseases. This stock has been on fire so far in 2014, with shares up sharply by 63%.

If you take a glance at the chart for Bluebird Bio, you'll notice that this stock has been uptrending a bit over the last month, with shares moving higher from its low of $30.33 to its recent high of $35.28 a share. During that uptrend, shares of BLUE have been making mostly higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of BLUE within range of triggering a near-term breakout trade above some key overhead resistance levels.

Traders should now look for long-biased trades in BLUE if it manages to break out above some near-term overhead resistance levels at $35.28 to around $37.50 a share with high volume. Watch for a sustained move or close above those levels with volume that hits near or above its three-month average action 518,069 shares. If that breakout develops soon, then BLUE will set up to re-test or possibly take out its next major overhead resistance levels at $40 to $41.22 a share, or its all-time high at $41.75 a share.

Read More: 5 M&A Deal Stocks to Watch for Premium Gains

Traders can look to buy BLUE off weakness to anticipate that breakout and simply use a stop that sits right around its 50-day moving average of $31.85 a share or near more key support at $30.33 a share. One can also buy BLUE off strength once it starts to move above those breakout levels share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Astronics

Another stock that's starting to trend within range of triggering a big breakout trade is Astronics (ATRO), which designs and manufactures products for the aerospace and defense industries worldwide. This stock is off to a decent start in 2014, with shares up notably by 17%.

If you take a glance at the chart for Astronics, you'll notice that this stock recently gapped up sharply higher from around $52 to $61.43 a share with monster upside volume. That move pushed shares of ATRO into breakout territory, since the stock cleared some key near-term overhead resistance levels at $56.14 a share and at $60 to $60.66 a share. Shares of ATRO pulled back a bit after that move, but now the stock is uptrending higher again and quickly approaching another big breakout trade above some key near-term overhead resistance levels.

Traders should now look for long-biased trades in ATRO if it manages to break out above some near-term overhead resistance levels at $61.43 to $62.72 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average volume of 145,861 shares. If that breakout materializes soon, then ATRO will set up to re-test or possibly take out its next major overhead resistance levels at around $68 to $70.40, or even its 52-week high at $72.99 a share.

Traders can look to buy ATRO off weakness to anticipate that breakout and simply use a stop that sits near its 50-day moving average of $56.06 or right around its gap-down-day low of $54.88 a share. One can also buy ATRO off strength once it starts to bust above those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Read More: 4 Stocks Warren Buffett Is Selling in 2014

Tesla Motors

My final breakout trading prospect is electric car maker Tesla Motors (TSLA), which develops, manufactures, and sells electric vehicles and electric vehicle powertrain components. This stock is off to a very strong start in 2014, with shares up sharply by 55%.

If you look at the chart for Tesla Motors, you'll notice that this stock ripped sharply higher on Friday right above its 50-day moving average of $220.19 a share with heavy upside volume. Volume registered 11.89 million shares, which is well above its three-month average action of 5.82 million shares. This sharp spike to the upside on Friday is quickly pushing shares of TSLA within range of triggering a major breakout trade above some key near-term overhead resistance levels.

Traders should now look for long-biased trades in TSLA if it manages to break out Friday's intraday high of $237.50 a share to some more key near-term overhead resistance levels at $240 to $244.49 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 5.82 million shares. If that breakout materializes soon, then TSLA will set up to re-test or possibly take out its next major overhead resistance levels at $260 to its all-time high at $265 a share. Any high-volume move above those levels will then give TSLA a chance to make a run at $300 a share.

Traders can look to buy TSLA off weakness to anticipate that breakout and simply use a stop that sits right around its 50-day moving average of $220.19 a share. One can also buy TSLA off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a conformable percentage from your entry point.

To see more breakout candidates, check out the Breakout Stocks of the Week portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>5 Stocks Insiders Love Right Now

>>3 Stocks Under $10 Moving Higher

>>4 Big Stocks on Traders' Radars

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

No comments:

Post a Comment