Craig Warga/Bloomberg/Getty Images There have been plenty of laggards in the restaurant business this earnings season, but Chipotle Mexican Grill (CMG) hasn't been one. Winter storms that slowed business to most eateries in January and the more problematic trends gnawing away at eating out in general during the balance of the quarter just didn't apply to Chipotle. The rapidly expanding chains saw comparable-restaurant sales soar 13.4 percent during the first three months of the year, bucking against the negative showings at most of the casual dining, fast food and even quick-service operators that have already reported. This is the kind of development that the market would naturally interpret as good news, but Chipotle hasn't been as lucky. In fact, the country's favorite burrito roller saw its stock hit a three-month low to kick off this new trading week, fetching levels last seen in late January. Investors are getting skittish about what they're seeing on the way down to the bottom line at Chipotle, likely unaware that today's challenge is tomorrow's opportunity. Inflation Station From coffee to milk, shrimp to limes, many food items are a lot more expensive than they were a year ago. That's inflation rearing its ugly head. Chipotle isn't adding shrimp to its menu anytime soon, and it just started testing coffee at a couple of airport locations late last year. However, it has been at the mercy of other menu components moving higher lately. The fast casual darling singled out the escalating costs of beef, avocados and cheese for nibbling away at its margins during this year's first quarter. The margin contraction was evident in Chipotle's latest quarterly report. Revenue climbed 24.4 percent as the combination of brisk expansion and hearty comps fueled another top-line pop. Net income, on the other hand, only rose 8.5 percent when pitted against last year's freshman quarter. A big reason for less of Chipotle's sales making it down to the bottom line is inflation. Food costs as a percentage of revenue has gone from 33 percent a year ago to 34.5 percent now. Spoiler alert: it's going to get worse in the near term. Chipotle's targeting food costs to eat up more than 36 percent of its revenue in the next couple of quarters, forcing analysts to scale back their earnings estimates for the current quarter. Higher Prices Aren't the End of the World The inflation is real. Cheese prices are expected to climb 10 percent this year, and it's even worse on the beef side where Chipotle's paying 25 percent more for its steak than it was when the year began. Everything from farmland droughts to a 30 percent reduction in California avocado production will result in Chipotle paying more to serve you that next foil-wrapped barbacoa burrito with cheese and guacamole. Chipotle has swallowed the increases so far, but a response is now coming after Chipotle missed Wall Street's profit forecast during the first quarter. "With all of this food inflation we have seen so far and expect to continue to see, we've decided to increase our menu prices," Chipotle announced during its mid-April earnings call. This is Chipotle's first company-wide increase in three years. It has gradually adjusted prices in some markets as competitive pressures allowed in the past, but now it has little choice but to introduce new menu boards this summer with slightly higher prices. Customers won't like it, but they're not likely to complain. The beauty of running a popular restaurant at a time of food inflation is that patrons will actually see bigger increases if they simply eat at home. After all, if items at the grocery store to assemble your meal theoretically doubled in price you would be treated to a 100 percent increase. Since food costs are a little more than a third of Chipotle's sales, passing on those costs to consumers would be closer to a 35 percent increase to keep profits intact. This is an extreme illustration, of course. Only some components have been moving higher. Chipotle believes that the increase will average somewhere in the mid-single-digits. In short, that carnitas bowl will cost you a little more, but it's not likely to break the bank. That should come as a relief to Chipotle fans heading out to lunch once the new menu boards get updated this summer, but it should also come as an even bigger relief for investors that weren't rewarded for owning the stock during an otherwise impressive quarter.

Craig Warga/Bloomberg/Getty Images There have been plenty of laggards in the restaurant business this earnings season, but Chipotle Mexican Grill (CMG) hasn't been one. Winter storms that slowed business to most eateries in January and the more problematic trends gnawing away at eating out in general during the balance of the quarter just didn't apply to Chipotle. The rapidly expanding chains saw comparable-restaurant sales soar 13.4 percent during the first three months of the year, bucking against the negative showings at most of the casual dining, fast food and even quick-service operators that have already reported. This is the kind of development that the market would naturally interpret as good news, but Chipotle hasn't been as lucky. In fact, the country's favorite burrito roller saw its stock hit a three-month low to kick off this new trading week, fetching levels last seen in late January. Investors are getting skittish about what they're seeing on the way down to the bottom line at Chipotle, likely unaware that today's challenge is tomorrow's opportunity. Inflation Station From coffee to milk, shrimp to limes, many food items are a lot more expensive than they were a year ago. That's inflation rearing its ugly head. Chipotle isn't adding shrimp to its menu anytime soon, and it just started testing coffee at a couple of airport locations late last year. However, it has been at the mercy of other menu components moving higher lately. The fast casual darling singled out the escalating costs of beef, avocados and cheese for nibbling away at its margins during this year's first quarter. The margin contraction was evident in Chipotle's latest quarterly report. Revenue climbed 24.4 percent as the combination of brisk expansion and hearty comps fueled another top-line pop. Net income, on the other hand, only rose 8.5 percent when pitted against last year's freshman quarter. A big reason for less of Chipotle's sales making it down to the bottom line is inflation. Food costs as a percentage of revenue has gone from 33 percent a year ago to 34.5 percent now. Spoiler alert: it's going to get worse in the near term. Chipotle's targeting food costs to eat up more than 36 percent of its revenue in the next couple of quarters, forcing analysts to scale back their earnings estimates for the current quarter. Higher Prices Aren't the End of the World The inflation is real. Cheese prices are expected to climb 10 percent this year, and it's even worse on the beef side where Chipotle's paying 25 percent more for its steak than it was when the year began. Everything from farmland droughts to a 30 percent reduction in California avocado production will result in Chipotle paying more to serve you that next foil-wrapped barbacoa burrito with cheese and guacamole. Chipotle has swallowed the increases so far, but a response is now coming after Chipotle missed Wall Street's profit forecast during the first quarter. "With all of this food inflation we have seen so far and expect to continue to see, we've decided to increase our menu prices," Chipotle announced during its mid-April earnings call. This is Chipotle's first company-wide increase in three years. It has gradually adjusted prices in some markets as competitive pressures allowed in the past, but now it has little choice but to introduce new menu boards this summer with slightly higher prices. Customers won't like it, but they're not likely to complain. The beauty of running a popular restaurant at a time of food inflation is that patrons will actually see bigger increases if they simply eat at home. After all, if items at the grocery store to assemble your meal theoretically doubled in price you would be treated to a 100 percent increase. Since food costs are a little more than a third of Chipotle's sales, passing on those costs to consumers would be closer to a 35 percent increase to keep profits intact. This is an extreme illustration, of course. Only some components have been moving higher. Chipotle believes that the increase will average somewhere in the mid-single-digits. In short, that carnitas bowl will cost you a little more, but it's not likely to break the bank. That should come as a relief to Chipotle fans heading out to lunch once the new menu boards get updated this summer, but it should also come as an even bigger relief for investors that weren't rewarded for owning the stock during an otherwise impressive quarter.

Top Dividend StocksFor 2014, Top Dividend Stocks To Buy

Wednesday, April 30, 2014

That Chipotle Burrito Bowl Will Soon Cost You More

Tuesday, April 29, 2014

Top 5 Electric Utility Companies For 2015

Whole Foods�Market�(NASDAQ:WFM) opened its first store in Austin, Texas, in 1980 and it has since become the undisputed king of organic grocers. The company has laid out plans to open 1,000 stores in the U.S. in the coming decades, but it remains to be seen if its business model can support this kind of growth in the long term. Let�� use our CHEAT SHEET investing framework to decide whether Whole Foods is an OUTPERFORM, WAIT AND SEE, or STAY AWAY.

C = Catalysts for the Stock�� MovementShares of Whole Foods jumped almost 10 percent on May 7 as the company announced strong second-quarter earnings. The organic grocer improved its gross margin by five basis points in the second quarter. This alleviated some concerns by investors that Whole Foods margin would erode as the competition intensified in the organic food space. Additionally, some analysts thought that Whole Foods��investments in price discounts and promotions would hurt its margins. Instead, these investments were offset by a reduction in administrative expenses due to greater economies of scale and strong comparable store sales growth of 6.9 percent.

Top 5 Electric Utility Companies For 2015: Teva Pharmaceutical Industries Limited (TEVA)

Teva Pharmaceutical Industries Limited, a pharmaceutical company, develops, produces, and markets generic drugs; and proprietary branded pharmaceuticals in various therapeutic categories and active pharmaceutical ingredients worldwide. The company?s provides generic drug portfolio of approximately 1,450 molecules and a direct presence in 60 countries. It offers generic pharmaceutical products in a range of dosage forms, such as tablets, capsules, ointments, creams, liquids, injectables, and inhalants. The company sells its generic injectable products to hospitals, clinics, and other institutional channels, primarily in the United States and Europe, as well as in Latin America and eastern Europe. Its branded products include Copaxone to treat multiple sclerosis; and Azilect to treat Parkinson?s disease, as well as biosimilars, respiratory, and women?s health products. The company was founded in 1901 and is headquartered in Petach Tikva, Israel.

Advisors' Opinion:- [By Maxx Chatsko]

Reasons for pessimism?

I may be digging a little bit here -- I admit it's tough to come up with negatives -- but Friday's announcement invalidating several Teva (NYSE: TEVA ) patents for multiple sclerosis drug Copaxone could shake up the market quite a bit. Could the emergence of two cheap generics from Momenta and Mylan in the first half of next year take some steam out of Tecfidera's rise? I can't see it being good news for either Teva or Biogen, but I'm not sure it's a death sentence, either.

Top 5 Electric Utility Companies For 2015: Scorpio Tankers Inc.(STNG)

Scorpio Tankers Inc. provides marine transportation of crude oil and refined petroleum products worldwide. As of April 26, 2011, it owned one LR2 tanker, four LR1 tankers, four Handymax tankers, and one post-Panamax tanker, as well as chartered one LR1 and four Handymax product tankers. The company was founded in 2009 and is based in Monaco, Monaco.

Advisors' Opinion:- [By Seth Jayson]

Scorpio Tankers (NYSE: STNG ) reported earnings on July 29. Here are the numbers you need to know.

The 10-second takeaway

For the quarter ended June 30 (Q2), Scorpio Tankers missed estimates on revenues and missed estimates on earnings per share. - [By Seth Jayson]

Scorpio Tankers (NYSE: STNG ) reported earnings on April 29. Here are the numbers you need to know.

The 10-second takeaway

For the quarter ended March 31 (Q1), Scorpio Tankers missed estimates on revenues and beat expectations on earnings per share.

Hot Wireless Telecom Companies To Own In Right Now: ProShares Short FTSE Xinhua China 25 (YXI)

ProShares Short FTSE China 25 (the Fund) is an exchange-traded fund. The Fund seeks daily investment results that correspond to the inverse (opposite) of the daily performance of the FTSE/Xinhua China 25 Index (the Index). The Index consists of 25 of the largest and most liquid Chinese stocks listed on the Hong Kong Stock Exchange. This free float adjusted Index caps the weight of any of constituent stock at 10% to ensure broad representation of the Chinese economy. The Fund seeks investment results for a single day only, not for longer periods. The Index is compiled and calculated by FTSE International Limited (FTSE) on behalf of FTSE/Xinhua Index Limited (FXI). The Fund will typically concentrate its investments in issuers of one or more particular industries to the same extent that its underlying Index is so concentrated. The Fund�� investment advisor is ProShare Advisors LLC. Advisors' Opinion:- [By pamatlarge]

Three short ETFs are designed to profit from China�� economic downward slide. The ProShares Short FTSE China 25 (YXI), an unleveraged ETF, holds shares in iShares FTSE China Large-Cap (FXI) swaps. Investors looking to magnify their returns can choose from two leveraged short ETFs: ProShares Ultra Short FTSE China 25 (FXP) and Direxion Daily China Bear 3x Shares (YANG). Both ProShares Ultra Short and Direxion Daily hold shares that increase in value three times faster than an unleveraged ETF. The downside is that the per share price of these leveraged ETFs also drops three times faster.

Top 5 Electric Utility Companies For 2015: Vectren Corporation (VVC)

Vectren Corporation, through its subsidiaries, provides energy delivery services to residential, commercial, and industrial and other contract customers in Indiana and west central Ohio. It offers natural gas distribution and transportation services, and electric distribution services; and owns and operates coal-fired and gas-fired electric generating facilities with an installed generating capacity of 1,298 megawatts. The company�s electric transmission system consists of 989 circuit miles of 345, 138, and 69 kilovolt lines, and 35 substations; and distribution system comprises 4,281 pole miles of lower voltage overhead lines and 372 trench miles of conduit containing 1,999 miles of underground distribution cable, 96 distribution substations, and 54,000 distribution transformers. In addition, it provides gas marketing, gas portfolio optimization, and other portfolio and energy management services to municipalities, utilities, industrial operations, schools, and healthcar e institutions; mines and sells coal; offers underground construction and repair, performance contracting, and renewable energy services; and invests in energy-related opportunities and services, real estate, and leveraged leases. Further, the company engages in transmission pipeline construction and maintenance; pump station, compressor station, terminal, and refinery construction; and hydrostatic testing services. It serves the automotive assembly, parts, and accessories; feed, flour, and grain processing; metal castings; aluminum products; polycarbonate resin and plastic products; gypsum products; electrical equipment; metal specialties; glass; steel finishing; pharmaceutical and nutritional products; gasoline and oil products; ethanol; and coal mining industries. As of December 31, 2011, it supplied natural gas services to approximately 993,300 customers; and electric services to approximately 141,600 customers. Vectren Corporation was founded in 1912 and is headquartere d in Evansville, Indiana.

Advisors' Opinion:- [By Chuck Carnevale]

Vectren Corp. (VVC): A Low Growth Utility

Our first example looks at Vectren Corp.�� historical earnings, a utility with a 15-year historical earnings growth rate that is below our 3% threshold established in Part 1. Note that fair valuation is calculated using Graham Dodd�� Formula (GDF) deriving a fair value PE of 13.8 (slightly below, but close to our PE 15 standard). However, a normal PE of 16 has been historically applied by Mr. Market. Therefore, valuation falls between a PE of 13.8 to 16, or well within a range of normalcy.

- [By Lawrence Meyers]

I like the diversification, and the fact that the company has offered many of these products for anywhere from 30 years to 100 years may explain why it�� paid a dividend for the last 32 years. That dividend is presently at 4.3%.

Vectren Corporation (VVC)The final stock on our list of secret dividend stocks is Vectren Corporation (VVC). VVC is another an energy play that�� diversified into four segments. The company provides 566,000 customers with natural gas delivery in Indiana.

Top 5 Electric Utility Companies For 2015: Vocera Communications Inc (VCRA)

Vocera Communications, Inc. (Vocera), incorporated on February 16, 2000, is a provider of mobile communication solutions. The Company�� solutions consist of its Voice Communication, Messaging and Care Transition solutions. Its Voice Communication solution, which includes a communication badge and a software platform, enables users to connect with other hospital staff. The Company�� Messaging solution delivers text messages and alerts directly to and from smartphones. Its Care Transition solution is a voice and text-based software application that captures, manages and monitors patient information when responsibility for the patient is transferred or handed-off from one caregiver to another, or when the patient is discharged from the hospital. Users can communicate with others using the Vocera communication badge or through Vocera Connect client applications available for BlackBerry, iPhone and Android smartphones, as well as Cisco wireless Internet protocol (IP) phones and other mobile devices. In January 2014, Vocera Communications Inc announced the acquisition of mVisum.

Communication solution can also be integrated with nurse call and other clinical systems to alert hospital workers to patient needs. The Company�� solutions are deployed in over 800 hospitals and healthcare facilities, including hospital systems, hospitals, and clinics, surgery centers and aged-care facilities. During the year ended December 31, 2011, the Company had shipped over 400,000 communication badges to its customers. The Company outsources the manufacturing of its products. Vocera offers a range of services, including clinical workflow design, wireless assessment, solution configuration, training and project management. It also provides a classroom-based curriculum for systems administrators, information technology professionals and clinical educators. The Company provides around-the-clock technical support to its customers through its support centers in San Jose, California, and Reading, United Kingdom.!

Voice Communication solution

The Company�� Voice Communication solution consists of a software platform that connects communication devices, including its hands-free, wearable, voice-controlled communication badges, Vocera-branded smartphones and third-party mobile devices that use its software applications to become part of the Vocera system. The system transforms the way mobile workers communicate by enabling them to connect with the right person simply by the name, function or group name of the person they want to reach, often while remaining at the point-of-care. Its system responds to over 100 voice commands.

Vocera�� Voice Communication solution is a software platform that runs on its customers��Windows-based servers. In addition, it controls the calling and messaging functions of the mobile client devices and maintains profiles for users and groups that enable customization of workflow patterns for each customer. The Company�� communication badge is a wearable device that operates over customers��wireless fidelity (Wi-Fi) networks. The badge is worn clipped to a shirt or on a lanyard. It can be used to conduct hands-free communication. It enables two-way voice conversations without the need to remember a phone number or use a handset. Its badge also incorporates automatic diagnostic mechanisms that feed data on wireless network performance back to the software platform for reporting and diagnosis of problems. In October 2011, it introduced the Vocera B3000 badge. In 2012, the Company added Cisco wireless IP phones to the list of mobile devices it supports.

Messaging solution

The Company�� Messaging solution delivers text messages, alerts and other information, directly to and from smartphones. Its solution consists of a software platform and client applications that run on BlackBerry, iPhone or Android devices. Its Messaging solution includes a range of client applications, including Alert, Chat and Commander.

Care! Transition Solution

The Company�� platform, which includes modules for patient transfers, shift changes, physician sign-outs and patient and family information exchanges, allows hospitals to standardize and monitor patient hand-offs. Its Care Transition solution can be deployed through either a hosted software-as-a-service model or as a server-on-site model and has been deployed by over 120 hospitals.

The Company competes with Cisco Systems, Ascom and Polycom.

Advisors' Opinion:- [By Evan Niu, CFA]

What: Shares of Vocera Communications (NYSE: VCRA ) have gotten slaughtered by 38% today after the company reported earnings.

So what: Revenue in the first quarter came in at $22.4 million, which translated into a non-GAAP net loss of $0.07 per share. Both figures were significantly worse than the $24.3 million in revenue and $0.02 per share adjusted loss that the Street was expecting. CEO Bob Zollars conceded that management was disappointed with the results.

BulletShares Lineup Expands Beyond 2020: Guggenheim ...

This bond ETF launch comes at an opportune time for bargain shoppers seeing as how fixed income securities across the board have endured a rough stretch of profit taking as a result of all the Fed-stimulus fears, which have already faded away for the most part.

Bond Bulls Eyeing New BulletShares ETFsThe new funds which hit the street today are the:

BulletShares 2021 Corporate Bond ETF

BulletShares 2022 Corporate Bond ETF Unlike most fixed income ETFs on the market today, the BulletShares product suite invests in debt securities scheduled to mature in a specific, single calendar year. As that year arrives and the debt begins to mature, proceeds are not reinvested but rather distributed to investors. For this reason, BulletShares ETFs have gained tremendous popularity since launching in 2010 as they more closely replicate the experience of investing in individual bonds while still providing immediate diversification across a basket of securities .

Similar to all of the existing corporate bond BulletShares ETFs, BSCL and BSCM will each charge 0.24% in expense fees.

Currently, the two most popular corporate bonds BulletShares ETFs by AUM targeting corporate bonds are the:

2015 Corporate Bond Fund 2014 Corporate Bond Fund The "junk bond" flavor of BulletShares has been even more successful, as these two High-Yield Bond ETFs dominate their investment grade-counterparts when it comes to total assets under management:

2015 High Yield Corporate Bond Fund 2014 High Yield Corporate Bond Fund Meet The Corporate Bond Fund CompetitionThe new BulletShares funds will join a fairly crowded space, ! comprised of over three dozen offerings with an average expense ratio of 0.22%. Although BulletShares separate themselves from the pack quite nicely by offering exposure that more closely resembles the purchase of an actual bond, BSCL and BSCM will still face stiff competition from more established funds; the Corporate Bonds ETFdb Category is dominated by:

iShares Investment Grade Corproate Bond Fund with $19 billions in AUM

iShares Barclays 1-3 Year Credit Bond Fund with nearly $11 billion in AUMVanguard Short-Term Corporate Bond ETF with over $6 billion in AUMThe new BulletShares products will likely taken on appeal among investors with more specific risk tolerance and current-income goals in mind given their unique, single-year maturity structure.

Follow me on Twitter @SBojinov

Disclosure: No positions at time of writing.

Sunday, April 27, 2014

10 Best & Worst Tax States for Retirees

In August, Kiplinger released an interactive map detailing the tax environment for retirees in each state. Users can compare up to five different states to get a picture of how their home states compares to others. Almost half the states were rated as tax-friendly or higher, with many of the most tax-friendly states concentrated in the South.

ThinkAdvisor looked for the five best and worst states for retirees to pay taxes in based on tax breaks offered to retirees; special considerations for retirement income; whether Social Security benefits were taxed and, of course, sales and income tax levels. We rated states that offered more benefits to retirees were better even if they had higher sales and income levels (and of course, states that offered fewer benefits came out worse).

(Check out Top 10 Offbeat, Cheap Cities for Retirement on ThinkAdvisor.)

Kiplinger published in October another interactive map that shows the tax environment in each state as it applies to residents as a whole instead of retirees.

5. Mississippi

Sales Tax: 7% with exemptions for prescriptions, residential utilities, motor fuel, newspapers, health care services and payments made by Medicare and Medicaid.

Income Tax: 3% for earners with less than $5,000 of taxable income; 5% for earners with more than $10,000 of taxable income.

Social Security Tax: None

Property Tax Breaks for Seniors: Disabled homeowners and those 65 and older have an exemption for the first $75,000 of property value.

Tax on Inheritances and Estates: None

Special Treatment for Other Retirement Income: Qualified retirement income is exempt from state income tax.

4. Georgia

Sales Tax: 4% with exemptions for food and prescriptions. Individual counties can add up to 4% more in sales tax.

Income Tax: 1% on the first $750 of taxable income for individuals; $500 for couples filing separately; $1,000 for couples filing jointly. The upper rate is 6% on individual earners with over $7,000; $5,000 for couples filing separately; $10,000 for couples filing jointly.

Social Security Tax: None

Property Tax Breaks for Seniors: Homeowners 62 and older are exempt from school taxes on $10,000 of their property's assessed value if they earn less than $10,000. Those with less than $30,000 may be exempt from state and local property taxes.

Tax on Inheritances and Estates: None

Special Treatment for Other Retirement Income: Disabled taxpayers or those older than 62 are eligible for an adjustment on retirement income on their state tax return.

3. Delaware

Sales Tax: None

Income Tax: 2.2% for earners with less than $5,000 in taxable income; 6.75% for earners with over $60,000. The rate for high earners will fall to 6.6% in January.

Social Security Tax: None

Property Tax Breaks for Seniors: Homeowners older than 65 are eligible for a credit of half of school property taxes up to $500 if they were residents prior to Dec. 31, 2012. Those who moved to the state after that date have to be residents for three years to be eligible for the credit.

Tax on Inheritances and Estates: No inheritance tax. The maximum estate-tax rate is 16%, with a %5.25 million exemption for 2013.

Special Treatment for Other Retirement Income: Taxpayers older than 60 can exclude $12,500 of investment and qualified pension income, even on out-of-state government pensions. The exclusion for those under 60 is $2,000.

2. Wyoming

Sales Tax: 4% with exemptions for food and prescriptions. Individual counties can add up to 3% more in sales tax.

Income Tax: None

Social Security Tax: None

Property Tax Breaks for Seniors: Residents 65 and older who meet income requirements are eligible for a tax rebate of up to $700 for individuals and $800 for couples.

Tax on Inheritances and Estates: None

Special Treatment for Other Retirement Income: Retirement income is not taxed.

1. Alaska

Sales Tax: There’s no state tax, but some municipalities charge a local sales tax.

Income Tax: None

Social Security Tax: None

Property Tax Breaks for Seniors: Homeowners over 65 and surviving spouses over 60 don’t have to pay municipal taxes on the first $150,000 of value on their property.

Tax on Inheritances and Estates: None

Special Treatment for Other Retirement Income: Retirement income is not taxed.

5. California

Sales Tax: A temporary tax hike set to expire in 2016 raised the rate from 7.25% to 7.5%. Some counties may have higher rates. Food and prescription drugs are exempt.

Income Tax: The lowest rate is 1% for single filers with up to $7,455; $14,910 for married joint filers. The highest rate is 13.3% for those with more than $1 million.

Social Security Tax: None

Property Tax Breaks for Seniors: None

Tax on Inheritances and Estates: None

Special Treatment for Other Retirement Income: Railroad retirement and Social Security benefits are exempt, but all other retirement income is taxable.

4. Nebraska

Sales Tax: 5.5% with exemptions for food and prescription drugs.

Income Tax: 2.46% for single earners with less than $2,400 of taxable income; $4,800 for married couples filing jointly. The upper rate is 6.84% for single filers with taxable income over $27,000 and $54,000 for married couples filing jointly.

Social Security Tax: Social Security benefits are taxed at the same rate as federal taxes.

Property Tax Breaks for Seniors: Homeowners 65 and older who meet income restrictions are eligible for exemptions if they occupy the house from January 1 through August 15. Single filers earning less than $25,801 and married filers earning less than $30,301 may be eligible for as much as $40,000 or 100% of their county's average value of single-family residential properties.

Tax on Inheritances and Estates: No estate tax, and assets inherited by a spouse or charity are not taxed. Other inheritance taxes are levied by counties and are between 1% and 18%.

Special Treatment for Other Retirement Income: None

3. Rhode Island

Sales Tax: 7% with exemptions for groceries, most clothing and footwear, precious-metal bullion under some circumstances and prescription drugs.

Income Tax: 3.75% for earners with up to $58,600 of taxable income; 5.99% for earners with taxable income over $133,250.

Social Security Tax: Social Security is taxed at the federal level. Single earners with provisional income of $25,000 or more, $32,000 for married earners filing jointly, are subject to tax on Social Security benefits.

Property Tax Breaks for Seniors: Homeowners 65 and older who earn less than $30,000 are eligible for a $300 tax credit on property taxes.

Tax on Inheritances and Estates: No inheritance tax, but the maximum estate tax rate is 16%. The exemption for 2013 is $910,725, and is adjusted for inflation every year.

Special Treatment for Other Retirement Income: Railroad retirement benefits are exempt, but most other income is taxable.

2. Minnesota

2. Minnesota

Sales Tax: 6.87% with exemptions for food, clothing, and prescription and nonprescription drugs.

Income Tax: 5.35% for single filers with less than $24,270 of taxable income; $35,480 for joint filers. The upper rate is 9.85% for single filers with more than $150,000 of taxable income; $250,000 for joint filers.

Social Security Tax: Taxed at federal level.

Property Tax Breaks for Seniors: People 65 or older with less than $60,000 in household income can defer part of their property taxes to the state. Interest will be charged and a lien will be attached to the property.

Tax on Inheritances and Estates: No inheritance tax, but estate taxes have an exclusion of $1 million. The maximum estate tax rate is 16%.

Special Treatment for Other Retirement Income: Railroad retirement benefits are not taxed, but other retirement income is.

1. Vermont

Sales Tax: 6% with exemptions for food, clothing, prescription and nonprescription drugs. Local jurisdictions may add 1%.

Income Tax: 3.55% for individual earners with up to $36,250 of taxable income; $59,050 for married couples. The upper rate is 8.95% for single and joint filers with taxable income over $398,350.

Social Security Tax: Taxed at the federal level.

Property Tax Breaks for Seniors: None, although veterans or their surviving spouses and children can claim an exemption of the first $10,000 of appraisal value of their residence.

Tax on Inheritances and Estates: No inheritance tax, but estate tax applies to properties worth more than $2.75 million. The maximum estate tax rate is 16%.

Special Treatment for Other Retirement Income: Railroad retirement benefits are exempt; all other retirement income is taxed.

-- Check out these Top 10 lists on ThinkAdvisor:

States where the most children go hungry

Feeding America — the largest hunger relief charity and network of food banks in the U.S. — created Map the Meal Gap, a study measuring food-insecurity among the general population and children at the state and county levels. While hunger remains a problem nationally, some areas of the country had nearly double the national rate. Food-insecurity rates among children were as high as 41% in Zavala County, Texas. At the state level, New Mexico led the nation with 29.2% of children living in food-insecure households.

According to Ross Fraser, Director of Media Relations at Feeding America, children are of course more vulnerable to poverty and food-insecurity because they can't work. "You have a lot of people with large families who live in poverty, and children can't change their financial circumstances," he said.

The situation may also be considerably worse than it seems. Benefits from the Supplemental Nutrition Assistance Program (SNAP) have been sharply reduced since November 2013, after the data for the report was collected. Prior to the cut, 45% of all SNAP beneficiaries were children, according to Feeding America.

The states with the highest child food-insecurity rates are clustered in particular regions, and tend to be sparsely populated. These include states along the Mexican border, such as Texas, New Mexico, Arizona, as well as states like Mississippi. In general, they have fewer highways, less public transportation.

It is relatively easy to get on a bus and get to a food bank in a big city, explained Fraser. However, it's different "if you're living in the middle of nowhere in ! Wyoming, where there is no public transportation and you might be a hundred miles from the nearest food pantry, and you don't have a working car, and there's not a grocery store within miles and miles."

Not surprisingly, states where children have limited access to adequate meals had high poverty and unemployment rates. The 10 states with the highest child food-insecurity rates identified by Feed America had poverty rates, as well as child poverty rates, in excess of the national rate. In Mississippi the poverty rate for children was 35%, well above the national rate of 23%. Eight of the 10 states had unemployment rates exceeding the national rate of 6.6% in 2012.

According to Feeding America, prevalence of a number of chronic illnesses is higher among people living in food-insecure households. When it is difficult to find adequate meals on a regular basis, the chances of negative health outcomes go up. Fraser explained that "you have to have a healthy and nutritious diet in order to have a healthy active lifestyle — whenever that's compromised, you put that at risk." The problem can be even more severe for children. "The lack of adequate nutrition can literally change the architecture of a child's brain," Fraser pointed out.

Incidence of diabetes and obesity was especially high in the states with high rates of food-insecurity. "People who live in homes that are food-insecure have twice the rate of type 2 diabetes," said Fraser. Five states with the highest food-insecurity among children — Mississippi, Georgia, Arkansas, Texas, and North Carolina — had obesity rates above the national rate of 27.1%.

To identify the states with the highest rates of child food-insecurity, 24/7 Wall St. relied on Feeding America's report on state, county and congressional district level food-insecurity in the United States. The report measured limited access to adequate food based on a model incorporating factors such as food costs, unemployment, and poverty rates. For children, the model incl! uded elig! ibility for various school lunch programs. The model relied on 2012 data from the USDA, Bureau of Labor Statistics and U.S. Census Bureau. We also considered 2012 data from the U.S. Census Bureau, and the Bureau of Labor Statistics. Data from the Gallup-Healthways Well-Being Index is from 2012 and 2013.

These are the states where the most children go hungry.

10. North Carolina

> Child food-insecurity: 26.7%

> Child poverty rate: 26.0% (10th highest)

> 2012 Unemployment rate: 9.2% (tied-5th highest)

> Pct. with SNAP benefits: 15.3% (17th highest)

Like many of the states with high food-insecurity among children, smaller, rural communities were more likely to struggle to limited access to food. More than 20% of individuals living in Hyde County, for example, had uncertain or inadequate access to food in 2012, among the highest rates of any county in the U.S. Poor food-security also placed people at a greater risk of negative health outcomes. In a recent Gallup poll, more than 13.2% of North Carolina residents reported that they had been diagnosed with diabetes, among the nation's highest rates. North Carolina had among the worst poverty rates in 2012, with 18% of residents living below the poverty level, compared to 15.9% nationwide. The unemployment rate was also particularly bad, at 9.2% in 2012, worse than all but a handful of states.

9. Oregon

> Child food-insecurity: 27.3%

> Child poverty rate: 23.0% (20th highest)

> 2012 Unemployment rate: 8.8% (tied-11th highest)

> Pct. with SNAP benefits: 20.1% (the highest)

More than one in five Oregon residents relied on food stamps in 2012, the highest rate in the nation. Given the importance of government assistance for families in the state, the high rate of child food-insecurity, 27.3%, may not be surprising. Some have argued that historically high housing costs — Oregon's median home price was $223,900 in 2012, compared with just $171,900 nationwide — have driven up the h! omeless r! ate in the state. According to Children First for Oregon, a non-profit, nearly 4% of Oregon public school students were homeless in recent years, nearly the highest rate nationwide. Unlike many of the states with high food-insecurity, residents tended to be in good health. Obesity, diabetes and hypertension were all below the national rate.

MORE: States with the highest (and lowest) taxes

8. Texas

> Child food-insecurity: 27.4%

> Child poverty rate: 25.8% (11th highest)

> 2012 Unemployment rate: 6.8% (16th lowest)

> Pct. with SNAP benefits: 14.3% (23rd highest)

There were nearly seven million children living in Texas in 2012, more than any state except California. Of that number, more than 27%, or 1.9 million, had difficulty finding adequate meals over the course of the year. The problem was even worse in some small rural communities. More than 40% of children living in Zavala County, were considered food-insecure — by far the worst rate nationwide. While smaller communities tend to be more vulnerable, residents of larger communities often struggled with food-security as well. Of 15 counties with at least 100,000 food-insecure children, four were in Texas. More than one fifth of the under-18 population struggled to find adequate meals in each of these four counties. Limited access to crucial needs was hardly limited to food in Texas. No state had a greater percentage of its residents living without health insurance — 22.5% in 2012.

7. Florida

> Child food-insecurity: 27.6%

> Child poverty rate: 25.4% (13th highest)

> 2012 Unemployment rate: 8.8% (tied-11th highest)

> Pct. with SNAP benefits: 15.2% (18th highest)

Miami-Dade County was one of just 15 counties nationwide where more than 100,000 children suffered from food-insecurity. Florida had a relatively high unemployment rate in 2012 — 8.8%, compared with a 8.1% national rate in 2012. Household income, on the other hand, was just $45,040 in 2012, considerably lo! wer than ! the national median of $51,371. Like Texas, Florida residents had among the lowest rates of health insurance — 20.1% of residents were uninsured in 2012. Low health insurance coverage only makes matters worse when limited access to food is already producing poor health outcomes. Floridians were more likely to have been diagnosed with diabetes and to have previously suffered a heart attack than Americans in most other states.

MORE: Ten states with the lowest unemployment

6. Arkansas

> Child food-insecurity: 27.7%

> Child poverty rate: 28.5% (3rd highest)

> 2012 Unemployment rate: 7.5% (22nd lowest)

> Pct. with SNAP benefits: 15.5% (14th highest)

Like several states with poor food-security for children, Arkansas struggles with low median incomes and high poverty rates. A typical household in the state earned just over $40,000 in 2012. One in five state residents was living in poverty that year, higher than all but a handful of states. Poverty was even worse among children. Nearly 30% of residents under age 18 were living in poverty that year, third-highest nationally. Poor food-security can lead to poor health outcomes, such as obesity. More than 32% of Arkansas residents were obese last year, among the highest rates nationwide.

5. Nevada

> Child food-insecurity: 28.1% (tied-4th highest)

> Child poverty rate: 24.0% (17th highest)

> 2012 Unemployment rate: 11.5% (the highest)

> Pct. with SNAP benefits: 12.6% (19th lowest)

Food-insecurity among children is often reflected by participation in various school lunch programs. At least half of Nevada children were eligible for reduced lunch programs, actually lower than the nation rate — 80% of American children are eligible nationally. However, Nevada's state government has recognized that at least 20 rural schools did not know about these programs or were unable to participate due to lack of resources. Among the larger counties where data was available, Clark County, which! includes! the city of Las Vegas, was home to 124,600 children living in food-insecure households, among the highest figures for all U.S. counties. A poor job market may also have contributed to food-insecurity. The unemployment rate in Nevada was 11.5% in 2012, the worst rate in the country.

MORE: The fattest states in America

4. Georgia

> Child food-insecurity: 28.1% (tied-4th highest)

> Child poverty rate: 27.2% (6th highest)

> 2012 Unemployment rate: 9.0% (8th highest)

> Pct. with SNAP benefits: 16.5% (tied-9th highest)

Like many states where child food-insecurity was prevalent, Georgia struggles with high poverty rates. Nearly one in five individuals in the state lived below the poverty line in 2012, including 27% of children, both among the worst rates nationwide. Residents also relied more heavily on food stamps than in most other states, with 16.5% collecting SNAP benefits in 2012, compared with 13.6% nationwide. Health outcomes were also poor in the state, with diabetes and obesity rates both higher than the national rate. The unemployment rate was also quite high, at 9% in 2012, worse than all but a handful of states. Muscogee and Fulton counties had unemployment above 9% and food-insecurity rates of roughly 20%.

3. Arizona

> Child food-insecurity: 28.2%

> Child poverty rate: 27.0% (7th highest)

> 2012 Unemployment rate: 8.3% (14th highest)

> Pct. with SNAP benefits: 14.5% (22nd highest)

Nearly 250,000 children lived in food-insecure households in Maricopa County, which includes Phoenix, more than in all but a few counties nationwide. The food-insecurity rate in the county was 24.6%, actually lower than the statewide rate, which was more than 28% in 2012. Like most states suffering from food-insecurity, Arizona struggles with high poverty rates and a relatively high unemployment rate. The child poverty rate was 27% that year, and 8.3% of the workforce was unemployed, both among the worst nationwide.

MORE: Ten sta! tes where! inequality has soared

2. Mississippi

> Child food-insecurity: 28.7%

> Child poverty rate: 34.7% (the highest)

> 2012 Unemployment rate: 9.2% (tied-5th highest)

> Pct. with SNAP benefits: 19.4% (2nd highest)

Mississippi was home to the county with the highest food-insecurity rate in the nation, Humphreys County, where 33% of all residents were unable to reliably find three adequate meals a day. Mississippi continued to lead the nation with a poverty rate of more than 24.2% in 2012. The poverty rate for children was even higher, at 35% — the highest rate nationwide. Low incomes in the state help explain the high poverty rates. A typical Mississippi household made less than $37,095 in 2012, a lower median income than any other state. Mississippi had the highest obesity rate of any state in 2012, and residents were more likely to be diagnosed with diabetes and have previously had a heart attack than the vast majority of Americans.

1. New Mexico

> Child food-insecurity: 29.2%

> Child poverty rate: 29.3% (2nd highest)

> 2012 Unemployment rate: 7.1% (22nd lowest)

> Pct. with SNAP benefits: 16.5% (tied-9th highest)

Nearly 30% of children were living in food-insecure households in New Mexico, the highest rate in the country. While unemployment was actually lower than the national rate, at 7.1% in 2012, the state has struggled with a low median income and high poverty rates. More than 20% of all individuals, and nearly 30% of children, lived below the poverty line in 2012, both second-worst in the nation. New Mexico's poverty problem is among the nation's oldest and most severe. According to the USDA, the state is designated as an area of "persistent poverty" with the problem extending back to at least the 1970 Census.

24/7 Wall St. is a USA TODAY content partner offering financial news and commentary. Its content is produced independently of USA TODAY.

Saturday, April 26, 2014

Facebook's Earnings Results Deliver the Likes

Judging by Facebook's (NASDAQ: FB ) stellar performance post earnings announcement, its second-quarter results didn't disappoint last night. The company reported revenues of $1.81 billion, an increase of 53% year over year, translating to a non-GAAP net income increase of 65%, to $488 million, or $0.19 a share. The analyst consensus was hoping Facebook would earn $1.62 billion in revenue and bring home $0.12 a share in earnings.

For the month of June, the average number of daily active users increased by 27% year over year, to 699 million. The social network closed its quarter with 1.15 billion monthly active users, an increase of 21% year over year. Additionally, mobile monthly active users now represent 71% of all Facebook users and, as a percentage of advertising revenue, it accounted for 41%, a strong improvement from the first quarter when mobile only made up 30% of advertising revenue. In other words, Facebook is monetizing mobile in a more effective manner.

Healthy vitals

One of the more effective ways to measure the health of Facebook's business is to look at how its average revenue per user, or ARPU, is faring against monthly active user growth. By comparing these two metrics, you can get a better sense of what's driving Facebook's results -- user growth or improved monetization. Ultimately, when user growth begins to slow, user monetization will become the key driver of the business. Based on 1.15 billion monthly active users, every penny of ARPU generates $11.5 million in revenue to Facebook's top line.

On a year-over-year basis, user growth increased by 21%, but worldwide ARPU increased by 25%, to $1.60, indicating that Facebook is extracting value out of its existing users faster than it is growing its user base. This is a good sign of things to come, and shows that Facebook is figuring out how to more effectively monetize the world's largest social network.

Slow clap

Thanks to outsized growth in ARPU compared to user growth, investors should be pleased that Facebook's investments in earning the trust of marketers are beginning to pay off. Additionally, it appears that Facebook has begun to find its stride, easing fears that the company isn't just a social network, but also a viable business longer term. Throw in the many ways Facebook can improve its existing business, and it's likely that the company's earnings potential is still within the early stages.

Perhaps now is the time to buy?

So much of our technological lives are shaped and molded by just a handful of companies. Find out "Who Will Win the War Between the 5 Biggest Tech Stocks?" in The Motley Fool's latest free report, which details the knock-down, drag-out battle being waged by the five kings of tech. Click here to keep reading.

Sarepta Therapeutics Inc. (SRPT): $54 Approved By JMP Securities

It's not every day that a stock is up 40% but still might have another 50%+ to go. However, that is the case with Sarepta Therapeutics Inc. (NASDAQ:SRPT).

Sarepta Therapeutics Inc., formerly AVI BioPharma, Inc., biopharmaceutical company focused on the discovery and development of ribonucleic acid (RNA)-based therapeutics for the treatment of rare and infectious diseases. Its product candidates include Eteplirsen, AVI-6002, AVI-6003, and AVI-7100.

From what we can gather online:

AVI-6002 is for the Ebola virus AVI-6003 is for Marburg hemorrhagic fever (MHF) AVI-7100 is for H1N1 (swine flu).

[Related -Stock End 1 Pct Higher On Earnings, Gold; Coca-Cola (KO) Jumps]

Al the hubaloo today is due to Eteplirsen. Earlier today, the company announced it plans to submit a New Drug Application (NDA) to the U.S. Food and Drug Administration (FDA) by the end of 2014 for the approval of eteplirsen for the treatment of Duchenne muscular dystrophy (DMD). Eteplirsen is Sarepta's lead exon-skipping drug candidate in development for the treatment of patients with DMD who have a genotype amenable to skipping of exon 51.

Chris Garabedian, president and chief executive officer says, "As we announce our plan to submit an eteplirsen NDA by the end of 2014, we are very pleased with the detailed guidance that the FDA has provided us on a potential eteplirsen approval pathway and their support of a historically controlled eteplirsen confirmatory study. We also appreciate that the FDA shares our urgency in dosing a broader base of eteplirsen patients and has encouraged us to begin the clinical program with our follow-on exon-skipping drugs as soon as possible."

[Related -Stock Upgrades And Downgrades: CHRW, DWA, ODFL, PXD, S, SRPT, TMO]

As such, management plans to initiate several additional clinical studies with eteplirsen later this year in exon-51 amenable genotypes.

A pair of research firms upped their opinions on SRPT on the FDA news. William Blair and JMP Securities moved to an "outperform" rating from "market perform." JPM put a price tag of $54 – upside potential of 58.82% to target.

According to the CDC, "Duchenne muscular dystrophy (DMD) is a genetic disorder that causes muscles to gradually weaken over time. A person with DMD will eventually lose the ability to walk and will have problems with breathing and his or her heart. It most often affects boys and occurs among all races and cultures. Sometimes this disorder affects other members of a person's family, but in many cases it is new to a family."

The Muscular Dystrophy Associations (MDA) says, "DMD is the most frequently occurring and one of the most rapidly progressive of the childhood neuromuscular disorders. It affects approximately 1 in 3500 live male births throughout the world. DMD affects only boys (with extremely rare exceptions)."

The CDC reports roughly 4 million babies are born in the US per year. Slightly more than half are boys, meaning a little more than 2 million "It's a Boys" annually. Using the MDA's 1 in 3,500 figure, we arrive at about 570 babies born a year with the condition.

At the moment, SRPT has a market cap of $1.28 billion on trailing twelve month (TTM) revenue of $14.22 million – 64.82 times sales is a steep price to pay.

The average biotech trades at 16 times sales. Now, if Sarepta Therapeutics captured 100% of the potential market for the next decade, they would have to charge $14,000 per year to generate enough revenue to meet the current market cap using the average price-to-sales ratio. That doesn't include any revenue sources beyond eteplirsen. At JPM's $54, the cost would have to be $22,314 per year to trade at the peer average P/S ratio.

Overall: In our opinion, Sarepta Therapeutics Inc. (NASDAQ:SRPT) is more likely to get to $54 compliments of a short squeeze as 40% of the float (stock available for trading) is sold, than from eteplirsen driven fundamentals.

Buffalo Wild Wings Leading on Tech Innovation

Buffalo Wild Wings Inc. (BWLD) owns, operates and franchises a chain of more than 900 casual dining restaurants across the United States and Canada. Buffalo Wild Wings has a strong brand prospect and is considered one of the most popular casual dining restaurant chains – with a dine and watch concept and 40 television sets per outlet. The company offers its chicken wings, hamburgers, sandwiches, salads and beers until 2am. Not only sports fan love Buffalo but also families which enjoy taking their children to restaurants where their children can watch TV and play videogames.

Its franchising system allows the company to safeward earnings. With more than 50% of its business franchised, the company reduces capital requirements and facilitates EPS growth and ROE expansion. Moreover, it also allows increasing free cash flow, which permits Buffalo to reinvest in brand recognition, and shareholder return.

Despite the unstable economic scenario, the company has managed to keep posting positive results, being well position within the market as to sustain its same-stores sales growth. Fourth quarter 2013 earnings of $1.10 were above estimations, increasing 23.6% versus 2012, driven by an increase in the top line and lower costs of sales. The new menu launches and marketing strategies are likely to continue boosting the company's sales, and the recent association with NCAA will further increases visibility.

Innovations

Buffalo Wild Wings has been investing in new product development. New menu items such as rib slammers, flat breads and Sam Adams Rebel IPA, the company's new beer, Buffalo, has been able to enhance its menu and attract more customers. It has also successfully changed its traditional way of menu serving chicken wings, with new weight based portions. These efforts have resulted on improved margins and more stable earnings.

Another initiative introduced in the guest experience business model is the installment of tablets in all of its restaurants to provide exclusive social gaming opportunities. Teaming up with NTN Buzztime Inc. (NTN) Buffalo uses Beond tablets to allow guests order food and drinks, play games, and pay their bill. Also, the three-year collaboration with National Collegiate Athletic Association (NCAA) has enabled the company to be an authorized hangout for the NCAA March Madness sports series, increasing visibility as a brand and attracting more customers to their outlets. These efforts, along with more intense advertising initiatives, new point-of-sales programs, improved supply chain and remodeling of its restaurants are expected to boost sales, and strengthen the business in the long run. Buffalo Wild Wings has selected the NCR Corp. (NCR) Aloha Online Ordering solution for its locations to help drive its takeout ordering business. The NCR technology will enable Buffalo to handle both on and off-premise transactions within one system.

Expansion

The company has also been focusing on store opening. Despite the macroeconomic uncertainty, Buffalo has kept with this initiative, and has witnessed unit growth of nearly 11.6% in 2011, 9.1% in 2012 and 10.9% in 2013. Moreover, associations are on track, and the company has acquired a minority stake in PizzaRev, launching in 2012 PizzaRev fast-casual pizza restaurant, with a Craft Your Own initiative. The company plans to open two more PizzaRev units in Minneapolis in 2014 and a few more outlets by the end of 2014. Another partnership on track is with Pepsico Inc. (PEP) and Dr. Pepper Snapple Group, Inc. (DPS) to serve drinks across all its locations. Through these partnerships, Buffalo Wild Wings is developing new sauces and salad dressings for the restaurant chain, like the Mountain Dew-flavored salad dressing and Doritos-flavored wing sauce. These partnerships are expected to increase visibility and improve guest traffic as well.

Economic setbacks

Macroeconomic uncertainties are always threatening restaurant industry companies, as the budget cuts, the high tax rates and tightened credit availability hurt consumer discretionary spending. In addition, the strong competition amid this industry intensifies margin pressures. Still, Buffalo Wild Wings margins are improving given their new initiatives. But the increased expenses and investments to fuel long-term growth might hurt profits in the near term.

The company's revenue missed analysts' estimates last quarter, but its traffic remained very strong. Top line increased year over year, and total revenue increased 12.4%, despite missing estimations of $345.0. Still, the growth of Buffalo Wild Wings has been outstanding: from 553 locations to more than 1,000 restaurants today, for a 12% compounded annual growth rate in locations.

Bottom line

The company has recently been developing numerous initiatives to attract more customers and enhance its brand furthermore. Improving its facilities, introducing technology and with different marketing campaigns, Buffalo is likely to keep in a highly competitive position and boost its sales. Buffalo Wild Wings' comparable-store sales increased 5% and its profit grew an astonishing 25%.

Disclosure: Damian Illia holds no position in any of the stocks mentioned

About the author:Damian IlliaA fundamental analyst at Lonetreeanalytics.com constantly looking for value and income investments.Visit Damian Illia's Website

| Currently 5.00/512345 Rating: 5.0/5 (1 vote) | Voters: |

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS | Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

136.52 (1y: +45%) $(function(){var seriesOptions=[],yAxisOptions=[],name='BWLD',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1367211600000,94.33],[1367298000000,89.993],[1367384400000,88.99],[1367470800000,90.28],[1367557200000,91.88],[1367816400000,92.49],[1367902800000,93.1],[1367989200000,92.98],[1368075600000,92.92],[1368162000000,94.61],[1368421200000,92.25],[1368507600000,94.18],[1368594000000,93.89],[1368680400000,94.82],[1368766800000,95.02],[1369026000000,96.14],[1369112400000,96.88],[1369198800000,95.33],[1369285200000,95.22],[1369371600000,94.53],[1369717200000,95.9],[1369803600000,95.19],[1369890000000,95.74],[1369976400000,95.96],[1370235600000,96.04],[1370322000000,95.85],[1370408400000,93.67],[1370494800000,95.36],[1370581200000,97.06],[1370840400000,98.01],[1370926800000,98.2],[1371013200000,97.02],[1371099600000,98.15],[1371186000000,97.35],[1371445200000,97.17],[1371531600000,99.3],[1371618000000,99.17],[1371704400000,97.46],[1371790800000,95.35],[1372050000000,94.44],[1372136400000,96.97],[1372222800000,99.37],[1372309200000,98.31],[1372395600000,98.24],[1372654800000,99.47],[1372741200000,99.58],[1372827600000,99.39],[1373000400000,101.24],[1373259600000,102.77],[1373346000000,103.65],[1373432400000,103.61],[1373518800000,104.34],[1373605200000,104.96],[1373864400000,105.05],[1373950800000,100.5],[1374037200000,100.26],[1374123600000,99.83],[1374210000000,100.06],[1374469200000,99.84],[1374555600000,98.12],[1374642000000,95.44],[1374728400000,95.92],[1374814800000,97.93],[1375074000000,98.39],[1375160400000,97.69],[1375246800000,103.58],[1375333200000,106.84],[1375419600000,107.14],[1375678800000,108.25],[1375765200000,106.9],[1375851600000,106.48],[1375938000000,106.92],[1376024400000,106.74],[1376283600000,106.25],[1376370000000,105.18],[1376456400000,105.08],[1376542800000,105.07],[1376629200000,104.92],[1376888400000,105.11],[1376974800000,107.19],[1377061200000,106.62],[1377147600000,109.55],[1377234000000,108.41],[1377493200000,107.98],[1377579600000,105.03],[1377666000000! ,105.12],[1377752400000,105.61],[1377838800000,103.91],[1378184400000,104.9],[1378270800000,105.76],[1378357200000,105.6],[1378443600000,104.68],[1378702800000,105.57],[1378789200000,107.27],[1378875600000,107.25],[1378962000000,107.4],[1379048400000,109.82],[1379307600000,110.62],[1379394000000,111.34],[1379480400000,110.87],[1379566800000,109.88],[1379653200000,109.55],[1379912400000,108.65],[1379998800000,108.35],[1380085200000,108.35],[1380171600000,109.83],[1380258000000,109.5],[1380517200000,111.175],[1380603600000,116.248],[1380690000000,120.36],[1380776400000,115.43],[1380862800000,116.04],[1381122000000,113.93],[1381208400000,113.1],[1381294800000,113.26],[1381381200000,117.12],[1381467600000,119.42],[1381726800000,119.21],[1381813200000,120.34],[1381899600000,119.6],[1381986000000,118.49],[1382072400000,119.43],[1382331600000,118.53],[1382418000000,123.06],[1382504400000,121.43],[1382590800000,121.11],[1382677200000,125.07],[1382936400000,126.36],[1383022800000,129.51],[1383109200000,141.22],[1383195600000,142.58],[1383282000000,142.745],[1383544800000,144.96],[1383631200000,150.38],[1383717600000,145.72],[1383804000000,143.07],[1383890400000,145.11],[1384149600000,144.51],[1384236000000,144.82],[1384322400000,145.31],[1384408800000,145.35],[1384495200000,149.92],[1384754400000,149.56],[1384840800000,149.24],[1384927200000,145.28],[1385013600000,151.82],[1385100000000,150.77],[1385359200000,149.93],[1385445600000,148.94],[1385532000000,150.8],[1385704800000,150.24],[1385964000000,149.58],[1386050400000,149.54],[1386136800000,146.75],[1386223200000,148],[1386309600000,149.28],[1386568800000,148.55],[1386655200000,146.43],[1386741600000,143.86],[1386828000000,141.77],[1386914400000,142.49],[1387173600000,143.58],[1387260000000,142.46],[1387346400000,147.14],[1387432800000,142.83],[1387519200000,143.96],[1387778400000,145.99],[1387864800000,145.46],[1388037600000,145.68],[1388124000000,146.08],[1388383200000,147.31],[1388469600000,147.2],[1388642400000,144.46],[1388728800000,143.57],[138898800000! 0,147.19]! ,[1389074400000,147.24],[1389160800000,151.49],[1389247200000,146.43],[1389333600000,144.55],[1389592800000,142.03],[1389679200000,144.73],[1389765600000,145.62],[1389852000000,143.32],[1389938400000,141.47],[1390284000000,136.88],[1390370400000,136.53],[1390456800000,134.85],[1390543200000,135.47],[1390802400000,133.8],[1390888800000,133.3],[1390975200000,133.04],[1391061600000,133.39],[1391148000000,141.86],[1391407200000,136.04],[1391493600000,140.75],[1391580000000,127.12],[1391666400000,131.88],[1391752800000,134.43],[1392012000000,132.55],[1392098400000,133.44],[1392184800000,131.96],[1392271200000,133.17],[1392357600000,132.4],[1392703200000,133.87],[1392789600000,132.31],[1392876000000,133.05],[1392962400000,132.27],[1393221600000,136.92],[1393308000000,136.85],[1393394400000,138.27],[1393826400000,144.97],[1393912800000,148.48],[1393999200000,147.05],[1394085600000,149.07],[1394172000000,151.91],[1394427600000,148.8],[1394514000000,148.33],[1394600400000,149.37],[1394686800000,147.31],[1394773200000,148.22],[1395032400000,151.64],[1395118800000,153.19],[1395205200000,151.18],[1395291600000,153.16],[1395378000000,156.35],[1395637200000,151.96],[1395723600000,147.51],[1395810000000,143.86],[1395896400000,141.55],[1395982800000,147.52],[1396328400000,152.04],[1396414800000,145.99],[1396501200000,146.83],[1396587600000,142.99],[1396846800000,140.07],[1396933200

136.52 (1y: +45%) $(function(){var seriesOptions=[],yAxisOptions=[],name='BWLD',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1367211600000,94.33],[1367298000000,89.993],[1367384400000,88.99],[1367470800000,90.28],[1367557200000,91.88],[1367816400000,92.49],[1367902800000,93.1],[1367989200000,92.98],[1368075600000,92.92],[1368162000000,94.61],[1368421200000,92.25],[1368507600000,94.18],[1368594000000,93.89],[1368680400000,94.82],[1368766800000,95.02],[1369026000000,96.14],[1369112400000,96.88],[1369198800000,95.33],[1369285200000,95.22],[1369371600000,94.53],[1369717200000,95.9],[1369803600000,95.19],[1369890000000,95.74],[1369976400000,95.96],[1370235600000,96.04],[1370322000000,95.85],[1370408400000,93.67],[1370494800000,95.36],[1370581200000,97.06],[1370840400000,98.01],[1370926800000,98.2],[1371013200000,97.02],[1371099600000,98.15],[1371186000000,97.35],[1371445200000,97.17],[1371531600000,99.3],[1371618000000,99.17],[1371704400000,97.46],[1371790800000,95.35],[1372050000000,94.44],[1372136400000,96.97],[1372222800000,99.37],[1372309200000,98.31],[1372395600000,98.24],[1372654800000,99.47],[1372741200000,99.58],[1372827600000,99.39],[1373000400000,101.24],[1373259600000,102.77],[1373346000000,103.65],[1373432400000,103.61],[1373518800000,104.34],[1373605200000,104.96],[1373864400000,105.05],[1373950800000,100.5],[1374037200000,100.26],[1374123600000,99.83],[1374210000000,100.06],[1374469200000,99.84],[1374555600000,98.12],[1374642000000,95.44],[1374728400000,95.92],[1374814800000,97.93],[1375074000000,98.39],[1375160400000,97.69],[1375246800000,103.58],[1375333200000,106.84],[1375419600000,107.14],[1375678800000,108.25],[1375765200000,106.9],[1375851600000,106.48],[1375938000000,106.92],[1376024400000,106.74],[1376283600000,106.25],[1376370000000,105.18],[1376456400000,105.08],[1376542800000,105.07],[1376629200000,104.92],[1376888400000,105.11],[1376974800000,107.19],[1377061200000,106.62],[1377147600000,109.55],[1377234000000,108.41],[1377493200000,107.98],[1377579600000,105.03],[1377666000000! ,105.12],[1377752400000,105.61],[1377838800000,103.91],[1378184400000,104.9],[1378270800000,105.76],[1378357200000,105.6],[1378443600000,104.68],[1378702800000,105.57],[1378789200000,107.27],[1378875600000,107.25],[1378962000000,107.4],[1379048400000,109.82],[1379307600000,110.62],[1379394000000,111.34],[1379480400000,110.87],[1379566800000,109.88],[1379653200000,109.55],[1379912400000,108.65],[1379998800000,108.35],[1380085200000,108.35],[1380171600000,109.83],[1380258000000,109.5],[1380517200000,111.175],[1380603600000,116.248],[1380690000000,120.36],[1380776400000,115.43],[1380862800000,116.04],[1381122000000,113.93],[1381208400000,113.1],[1381294800000,113.26],[1381381200000,117.12],[1381467600000,119.42],[1381726800000,119.21],[1381813200000,120.34],[1381899600000,119.6],[1381986000000,118.49],[1382072400000,119.43],[1382331600000,118.53],[1382418000000,123.06],[1382504400000,121.43],[1382590800000,121.11],[1382677200000,125.07],[1382936400000,126.36],[1383022800000,129.51],[1383109200000,141.22],[1383195600000,142.58],[1383282000000,142.745],[1383544800000,144.96],[1383631200000,150.38],[1383717600000,145.72],[1383804000000,143.07],[1383890400000,145.11],[1384149600000,144.51],[1384236000000,144.82],[1384322400000,145.31],[1384408800000,145.35],[1384495200000,149.92],[1384754400000,149.56],[1384840800000,149.24],[1384927200000,145.28],[1385013600000,151.82],[1385100000000,150.77],[1385359200000,149.93],[1385445600000,148.94],[1385532000000,150.8],[1385704800000,150.24],[1385964000000,149.58],[1386050400000,149.54],[1386136800000,146.75],[1386223200000,148],[1386309600000,149.28],[1386568800000,148.55],[1386655200000,146.43],[1386741600000,143.86],[1386828000000,141.77],[1386914400000,142.49],[1387173600000,143.58],[1387260000000,142.46],[1387346400000,147.14],[1387432800000,142.83],[1387519200000,143.96],[1387778400000,145.99],[1387864800000,145.46],[1388037600000,145.68],[1388124000000,146.08],[1388383200000,147.31],[1388469600000,147.2],[1388642400000,144.46],[1388728800000,143.57],[138898800000! 0,147.19]! ,[1389074400000,147.24],[1389160800000,151.49],[1389247200000,146.43],[1389333600000,144.55],[1389592800000,142.03],[1389679200000,144.73],[1389765600000,145.62],[1389852000000,143.32],[1389938400000,141.47],[1390284000000,136.88],[1390370400000,136.53],[1390456800000,134.85],[1390543200000,135.47],[1390802400000,133.8],[1390888800000,133.3],[1390975200000,133.04],[1391061600000,133.39],[1391148000000,141.86],[1391407200000,136.04],[1391493600000,140.75],[1391580000000,127.12],[1391666400000,131.88],[1391752800000,134.43],[1392012000000,132.55],[1392098400000,133.44],[1392184800000,131.96],[1392271200000,133.17],[1392357600000,132.4],[1392703200000,133.87],[1392789600000,132.31],[1392876000000,133.05],[1392962400000,132.27],[1393221600000,136.92],[1393308000000,136.85],[1393394400000,138.27],[1393826400000,144.97],[1393912800000,148.48],[1393999200000,147.05],[1394085600000,149.07],[1394172000000,151.91],[1394427600000,148.8],[1394514000000,148.33],[1394600400000,149.37],[1394686800000,147.31],[1394773200000,148.22],[1395032400000,151.64],[1395118800000,153.19],[1395205200000,151.18],[1395291600000,153.16],[1395378000000,156.35],[1395637200000,151.96],[1395723600000,147.51],[1395810000000,143.86],[1395896400000,141.55],[1395982800000,147.52],[1396328400000,152.04],[1396414800000,145.99],[1396501200000,146.83],[1396587600000,142.99],[1396846800000,140.07],[1396933200

Friday, April 25, 2014

3 Hot Stocks on Traders' Radars

BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>5 Mega-Cap Stocks to Trade for Gains

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>5 Stocks Under $10 Set to Soar

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

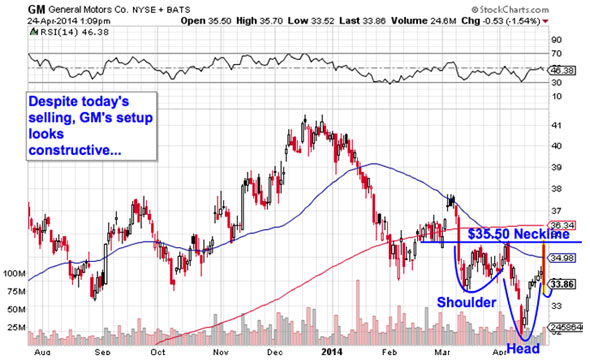

General Motors

Nearest Resistance: $35.50

Nearest Support: $32

Catalyst: Q1 Earnings

Despite some big black clouds over its first-quarter earnings call, General Motors (GM) beat analysts' expectations by 2 cents, taking home 6 cents per share in profit. Recalls hammered earnings, with a $1.3 billion one-time charge for recall repairs on the books. But while things were "less bad" than expected, investors are pushing shares lower on big volume this afternoon.

Looking longer-term, GM's chart could actually look a lot worse. This stock is looking "bottomy" after spending all of 2014 selling off to the tune of 14%. A breakout above $35.50 is the signal that it's time to be a buyer in GM.

ServiceNow

Nearest Resistance: $55

Nearest Support: $49

Catalyst: Q1 Earnings

$7 billion cloud-based IT service firm ServiceNow (NOW) is down 6% on big volume this afternoon, following a wider-than-expected loss for the first quarter. NOW lost 30 cents per share in the first three months of 2014, while investors were only expecting a consensus loss of 8 cents. The fundamental miss isn't a game-changer for this stock, but the technical miss paints a different picture.

NOW looks "toppy" in the longer-term. Shares have been forming a head and shoulders top since the start of October, a bearish setup that triggers on a move through support at $49. The setup in NOW is a long-term pattern, and that means that it comes with equally long-term trading implications on a breakdown below that $49 level. Shares flirted with a breakdown this morning before recovering later in the day. Keep a close eye on NOW's ability to catch a bid this week.

Verizon

Nearest Resistance: $48

Nearest Support: $44.50

Catalyst: Q1 Earnings, Technical Setup

Verizon Communications (VZ) is seeing some earnings-induced selling of its own this afternoon. Verizon posted its first-quarter numbers this morning, earning 84 cents for the last three months. That number fell 3 cents short of the 87 cent profit that analysts were expecting, but the real story is in subscriber count -- VZ lost wireless customers for the first time in its history last quarter, a byproduct of a hugely competitive market that's quickly becoming commoditized.

From a technical standpoint, the 2.7% drop on high volume today shouldn't come as a big surprise. After all, VZ has been bouncing lower in a well-defined trend channel since last November. With shares touching the top of the range back on Monday, a move lower was the high-probability outcome unless VZ really impressed investors. Look for shares to settle closer to $44.50 from here.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>QE5 Is Coming -- Here's What It Means to Your Portfolio

>>5 Stocks With Big Insider Buying

>>3 Big-Volume Stocks to Trade for Breakouts

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author was long AAPL.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

Thursday, April 24, 2014

Pump Prices Are Rising Quickly: Counterattack Now

Since the early 1970s, most major oil deals have been transacted in "petrodollars."

But that system has become increasingly challenged in recent years.

The conflict in Ukraine right now has only served to exacerbate things.

As America leads the charge to impose Western sanctions on Russia, it's a plan that's not only backfiring, but leading to opportunities for those who understand the consequences...

The Waning PetrodollarAfter Nixon infamously closed the gold window in 1971, something needed to be done to retain the U.S. dollar's status as world reserve currency.

So Kissinger and Nixon hatched the petrodollar system, whereby the United States would provide political and security support to Saudi Arabia's royal family.

In exchange, all oil deals would have to be transacted exclusively in dollars, so the House of Saud would buy lots of Treasuries with their greenbacks and influence other OPEC members to follow suit.

In effect, this guaranteed a constant and elevated (though artificial) demand for U.S. dollars worldwide.

But this fabricated demand is waning as trading nations question the need for a petrodollar, and even the U.S. dollar as a reserve currency.