Source: Sirius XM.

It was easy to be worried about Sirius XM Holdings (NASDAQ: SIRI ) heading into this morning's quarterly results, but the satellite radio provider silenced those concerns with another blowout report.

Pandora (NYSE: P ) stock took a hit last week when the music streamer reported financial results that included sequential dips for June in active users, content served, and even its share of the U.S. radio listening market. Was a shakeout starting in the bustling digital music market now that tech giants are throwing big money at acquisitions and connected cars are broadening their reach to play nice with newer streaming apps?

We don't know if Sirius XM's strong second quarter included any sequential dips between May and June. The satellite radio star never followed Pandora into the practice of putting out monthly metrics, which Pandora itself is no longer providing. However, we do know that Sirius XM held up nicely for the quarter as a whole.

Revenue rose 10% to $1.035 billion, above the 8% top-line uptick that analysts were targeting. Sirius XM's subscriber base topped 26.3 million, gaining 475,472 net additions during the quarter and more than 1.2 million over the past year.

Net income only inched 2% higher on a pre-tax basis, as operating expenses spiked higher during the period. The increase in expenses came mostly from higher revenue share and royalty payments, but marketing, customer service, and general and administrative costs also outpaced revenue and subscriber growth. That was countered by welcome dips in content costs and subscriber acquisition costs. Free cash flow, adjusted profitability, and EBITDA all rose at healthier clips from a year earlier.

Sirius XM's profit of $0.02 a share matched expectations. Despite being waist-deep in what is now $6 billion in stock buyback authorizations -- including 350,000 shares repurchased during the quarter itself -- there are still too many shares outstanding to move the needle on a per-share basis.

Rock on

Sirius XM stock opened 3% higher on Tuesday on the news. The revenue beat and encouraging subscriber growth were welcome, but the real driver pushing the stock up is Sirius XM boosting its full-year 2014 guidance higher for revenue, adjusted EBITDA, and free cash flow. It's true that Pandora took a hit last week despite boosting its own revenue and adjusted earnings outlook for the year. It's also true that Sirius XM kept its subscriber guidance intact. As long as the company continues to see its popularity swell -- something that Pandora investors didn't see between the months of May and June -- market sentiment will reward Sirius XM's overall performance.

There are plenty of moving parts here. More automakers are making it easier for folks to turn to a growing number of digital music apps right from their steering wheels and dashboards as long as they have a Bluetooth-tethered smartphone. This has opened up the alternatives beyond satellite radio as a fix to commercial-laden terrestrial radio, but wireless carriers weaning consumers off of unlimited data plans mean that these "free" ad-supported apps aren't entirely free.

Sirius XM appears to be holding up well in this environment. Strong auto sales are exposing more consumers to factory-installed receivers, and while conversion rates on these free trials are at a historical low of 42%, Sirius XM is clearly making it up in volume.

More from The Motley Fool: Warren Buffett Tells You How to Turn $40 Into $10 Million

Popular Posts: Biggest Movers in Healthcare Stocks Now – GPRO MNKD STJ CVD15 Oil and Gas Stocks to Sell Now9 Oil and Gas Stocks to Buy Now Recent Posts: Hottest Basic Materials Stocks Now – RGLD IAG GG PAAS Hottest Services Stocks Now – OIBR NTT EBAY SKM Biggest Movers in Consumer Cyclical Stocks Now – TRW WHR WPRT BC View All Posts 15 Oil and Gas Stocks to Sell Now

Popular Posts: Biggest Movers in Healthcare Stocks Now – GPRO MNKD STJ CVD15 Oil and Gas Stocks to Sell Now9 Oil and Gas Stocks to Buy Now Recent Posts: Hottest Basic Materials Stocks Now – RGLD IAG GG PAAS Hottest Services Stocks Now – OIBR NTT EBAY SKM Biggest Movers in Consumer Cyclical Stocks Now – TRW WHR WPRT BC View All Posts 15 Oil and Gas Stocks to Sell Now

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  48.42 (1y: -7%) $(function(){var seriesOptions=[],yAxisOptions=[],name='C',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373864400000,51.81],[1373950800000,51.83],[1374037200000,51.79],[1374123600000,52.69],[1374210000000,52.35],[1374469200000,53],[1374555600000,52.88],[1374642000000,52.19],[1374728400000,52.66],[1374814800000,52.21],[1375074000000,51.64],[1375160400000,51.78],[1375246800000,52.14],[1375333200000,52.86],[1375419600000,53],[1375678800000,52.87],[1375765200000,51.48],[1375851600000,51.5],[1375938000000,51.78],[1376024400000,51.32],[1376283600000,50.9],[1376370000000,51.77],[1376456400000,51.59],[1376542800000,50.86],[1376629200000,50.35],[1376888400000,49.33],[1376974800000,49.92],[1377061200000,49.16],[1377147600000,49.91],[1377234000000,49.83],[1377493200000,49.6],[1377579600000,48.24],[1377666000000,48.31],[1377752400000,48.47],[1377838800000,48.33],[1378184400000,49.37],[1378270800000,49.6],[1378357200000,49.86],[1378443600000,49.22],[1378702800000,50.09],[1378789200000,51.09],[1378875600000,50.73],[1378962000000,50.26],[1379048400000,50.49],[1379307600000,51],[1379394000000,51.2],[1379480400000,52.21],[1379566800000,51.95],[1379653200000,51.21],[1379912400000,49.57],[1379998800000,48.96],[1380085200000,49.26],[1380171600000,48.93],[1380258000000,48.89],[1380517200000,48.51],[1380603600000,48.6],[1380690000000,48.71],[1380776400000,48.4],[1380862800000,49.14],[1381122000000,48.18],[1381208400000,47.67],[1381294800000,47.95],[1381381200000,49.27],[1381467600000,49.22],[1381726800000,49.6],[1381813200000,48.86],[1381899600000,50.84],[1381986000000,51.12],[1382072400000,51.15],[1382331600000,51.03],[1382418000000,50.76],[1382504400000,50.19],[1382590800000,50.15],[1382677200000,50.06],[1382936400000,50.15],[1383022800000,50.22],[1383109200000,49.89],[1383195600000,48.78],[1383282000000,48.74],[1383544800000,48.63],[1383631200000,48.38],[1383717600000,48.62],[1383804000000,48.35],[1383890400000,49.94],[1384149600000,50.17],[1384236000000,49.52],[1384322400000,49.99],[13844088000! 00,50.21],[1384495200000,50.4],[1384754400000,50.79],[1384840800000,51.17],[1384927200000,50.77],[1385013600000,51.73],[1385100000000,52.41],[1385359200000,53.29],[1385445600000,53.01],[1385532000000,53.05],[1385704800000,52.92],[1385964000000,52.62],[1386050400000,52.13],[1386136800000,52.04],[1386223200000,51.06],[1386309600000,51.49],[1386568800000,52.11],[1386655200000,51.74],[1386741600000,50.71],[1386828000000,50.91],[1386914400000,50.97],[1387173600000,50.9],[1387260000000,50.69],[1387346400000,51.96],[1387432800000,51.88],[1387519200000,52.21],[1387778400000,52.41],[1387864800000,52.43],[1388037600000,52.35],[1388124000000,52.26],[1388383200000,51.92],[1388469600000,52.11],[1388642400000,52.2

48.42 (1y: -7%) $(function(){var seriesOptions=[],yAxisOptions=[],name='C',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373864400000,51.81],[1373950800000,51.83],[1374037200000,51.79],[1374123600000,52.69],[1374210000000,52.35],[1374469200000,53],[1374555600000,52.88],[1374642000000,52.19],[1374728400000,52.66],[1374814800000,52.21],[1375074000000,51.64],[1375160400000,51.78],[1375246800000,52.14],[1375333200000,52.86],[1375419600000,53],[1375678800000,52.87],[1375765200000,51.48],[1375851600000,51.5],[1375938000000,51.78],[1376024400000,51.32],[1376283600000,50.9],[1376370000000,51.77],[1376456400000,51.59],[1376542800000,50.86],[1376629200000,50.35],[1376888400000,49.33],[1376974800000,49.92],[1377061200000,49.16],[1377147600000,49.91],[1377234000000,49.83],[1377493200000,49.6],[1377579600000,48.24],[1377666000000,48.31],[1377752400000,48.47],[1377838800000,48.33],[1378184400000,49.37],[1378270800000,49.6],[1378357200000,49.86],[1378443600000,49.22],[1378702800000,50.09],[1378789200000,51.09],[1378875600000,50.73],[1378962000000,50.26],[1379048400000,50.49],[1379307600000,51],[1379394000000,51.2],[1379480400000,52.21],[1379566800000,51.95],[1379653200000,51.21],[1379912400000,49.57],[1379998800000,48.96],[1380085200000,49.26],[1380171600000,48.93],[1380258000000,48.89],[1380517200000,48.51],[1380603600000,48.6],[1380690000000,48.71],[1380776400000,48.4],[1380862800000,49.14],[1381122000000,48.18],[1381208400000,47.67],[1381294800000,47.95],[1381381200000,49.27],[1381467600000,49.22],[1381726800000,49.6],[1381813200000,48.86],[1381899600000,50.84],[1381986000000,51.12],[1382072400000,51.15],[1382331600000,51.03],[1382418000000,50.76],[1382504400000,50.19],[1382590800000,50.15],[1382677200000,50.06],[1382936400000,50.15],[1383022800000,50.22],[1383109200000,49.89],[1383195600000,48.78],[1383282000000,48.74],[1383544800000,48.63],[1383631200000,48.38],[1383717600000,48.62],[1383804000000,48.35],[1383890400000,49.94],[1384149600000,50.17],[1384236000000,49.52],[1384322400000,49.99],[13844088000! 00,50.21],[1384495200000,50.4],[1384754400000,50.79],[1384840800000,51.17],[1384927200000,50.77],[1385013600000,51.73],[1385100000000,52.41],[1385359200000,53.29],[1385445600000,53.01],[1385532000000,53.05],[1385704800000,52.92],[1385964000000,52.62],[1386050400000,52.13],[1386136800000,52.04],[1386223200000,51.06],[1386309600000,51.49],[1386568800000,52.11],[1386655200000,51.74],[1386741600000,50.71],[1386828000000,50.91],[1386914400000,50.97],[1387173600000,50.9],[1387260000000,50.69],[1387346400000,51.96],[1387432800000,51.88],[1387519200000,52.21],[1387778400000,52.41],[1387864800000,52.43],[1388037600000,52.35],[1388124000000,52.26],[1388383200000,51.92],[1388469600000,52.11],[1388642400000,52.2

Getty Images

Getty Images  PiperJaffray

PiperJaffray  PiperJaffray

PiperJaffray

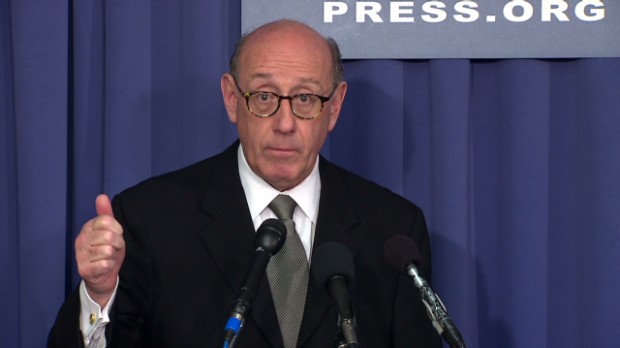

Feinberg's payout plan for GM victims NEW YORK (CNNMoney) There's no such thing as free money, but the compensation General Motors is offering victims comes pretty close.

Feinberg's payout plan for GM victims NEW YORK (CNNMoney) There's no such thing as free money, but the compensation General Motors is offering victims comes pretty close.  How GM will pay its victims

How GM will pay its victims  AP

AP